| Dear Students, If you find any question paper missing from any year, please contact us through our email address “bhmaims@gmail.com“ Also, if you have any missing past-year board question papers, kindly forward them to us so that we can update in our website. |

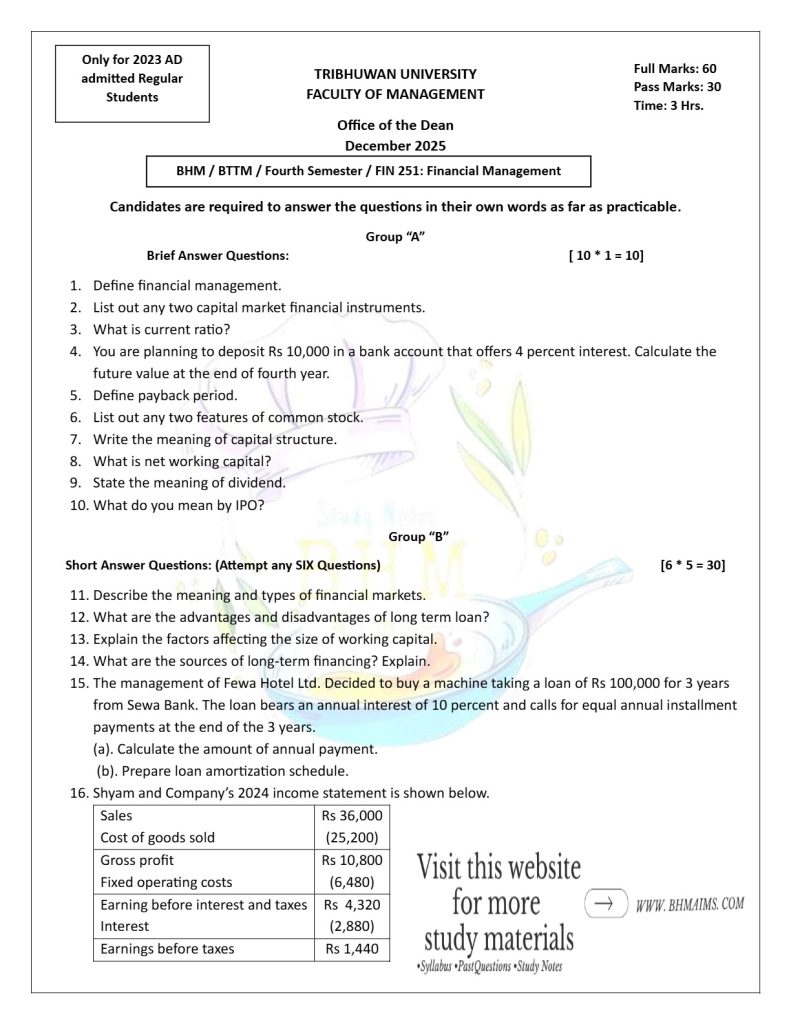

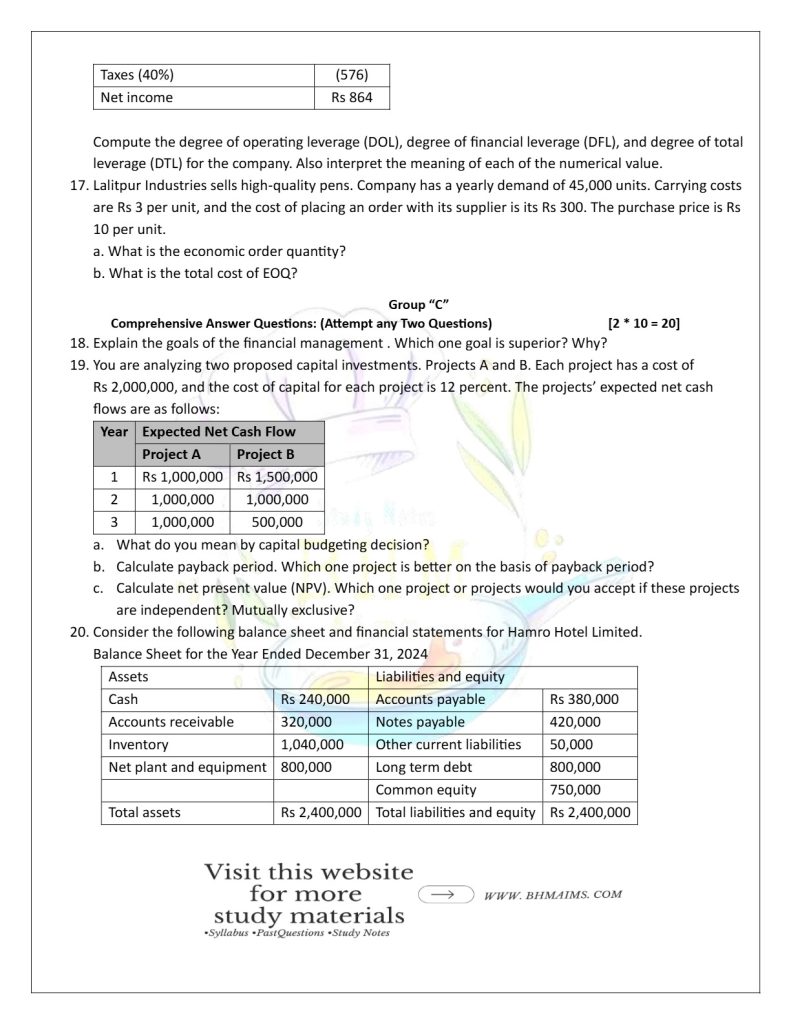

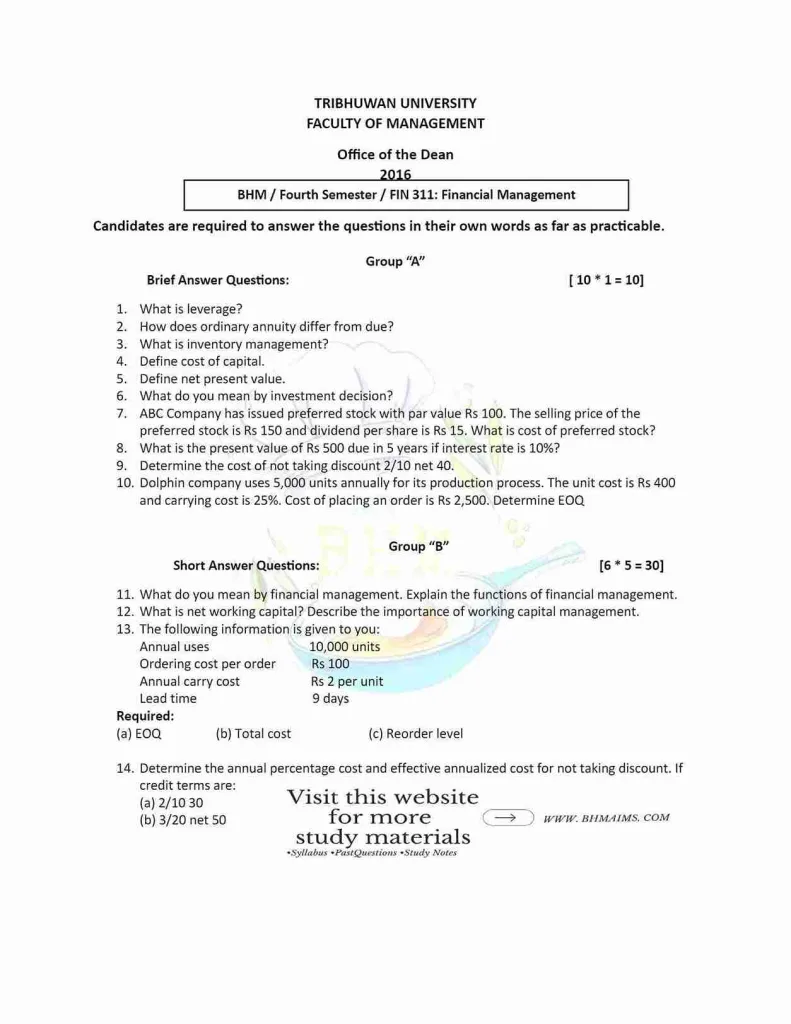

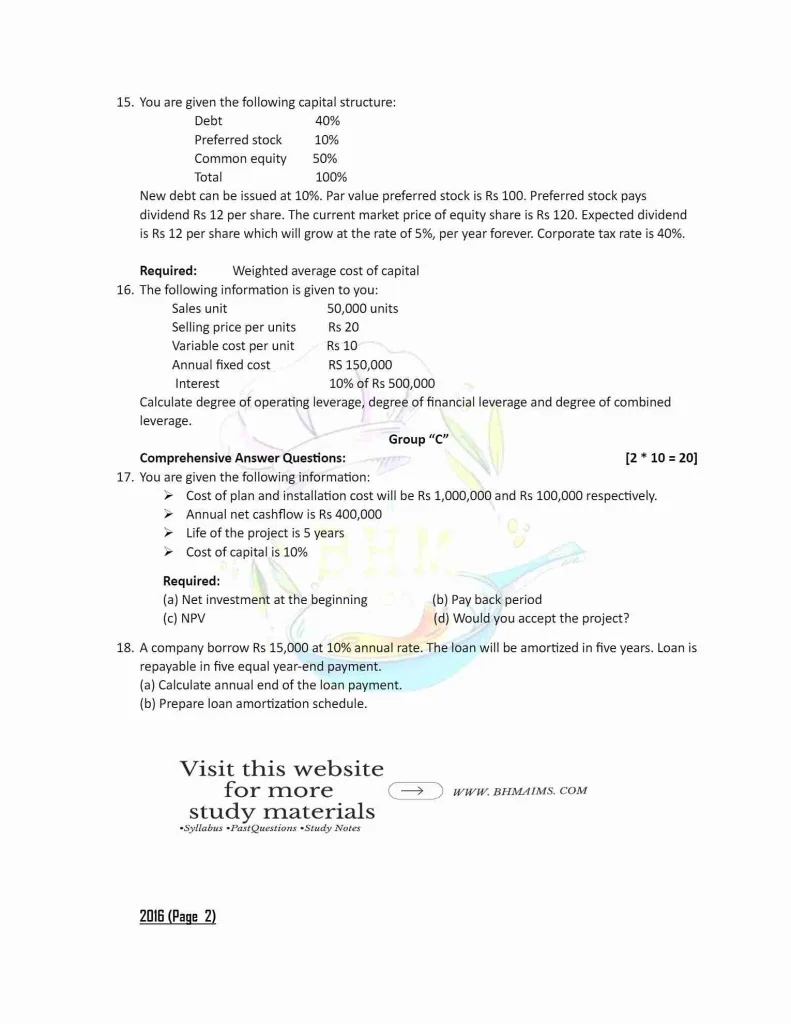

Financial Management Year 2016 Question Paper

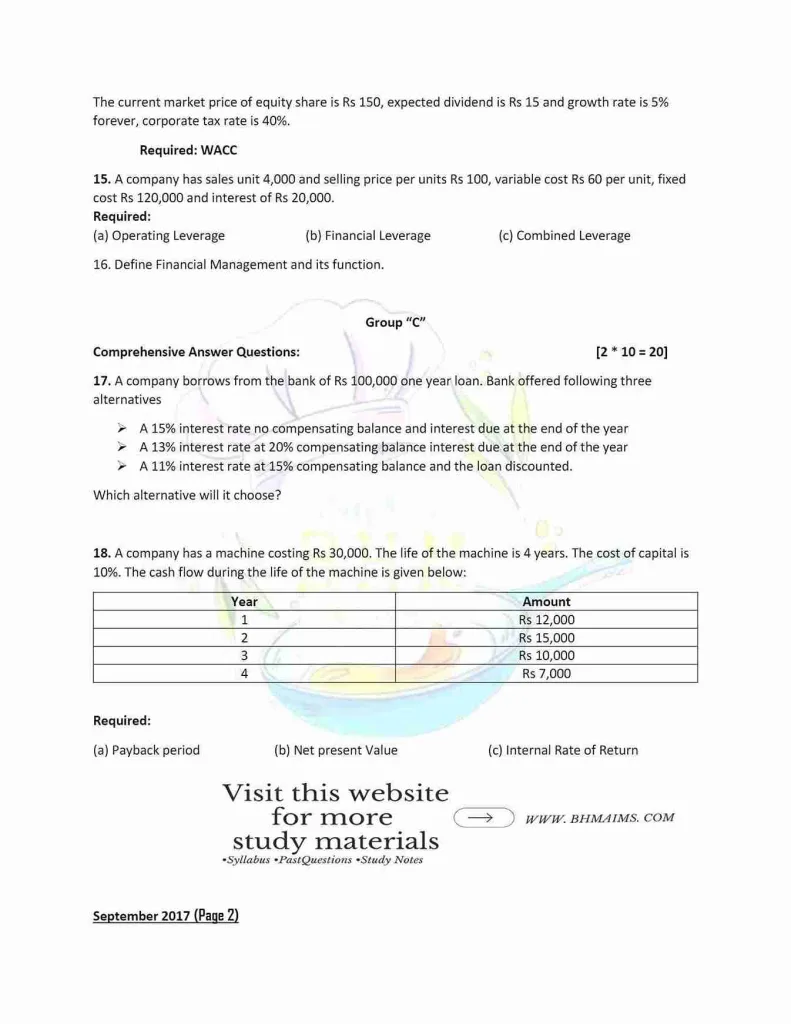

Financial Management Year 2017 Question Paper

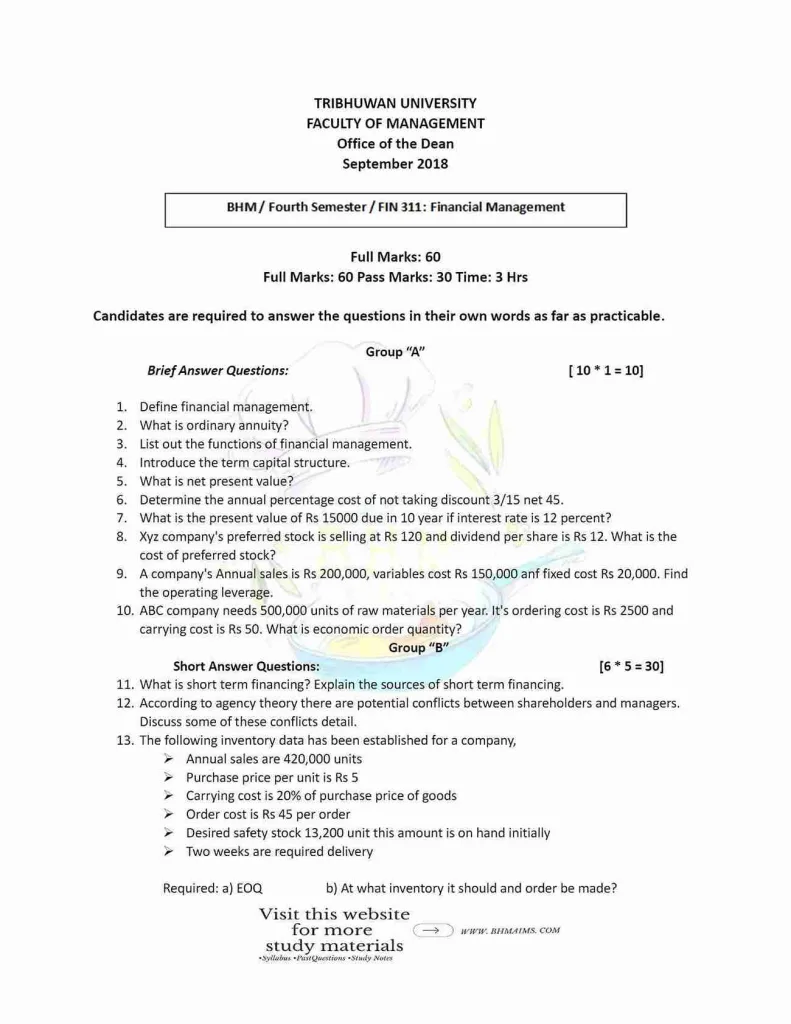

Financial Management Year 2018 Question Paper

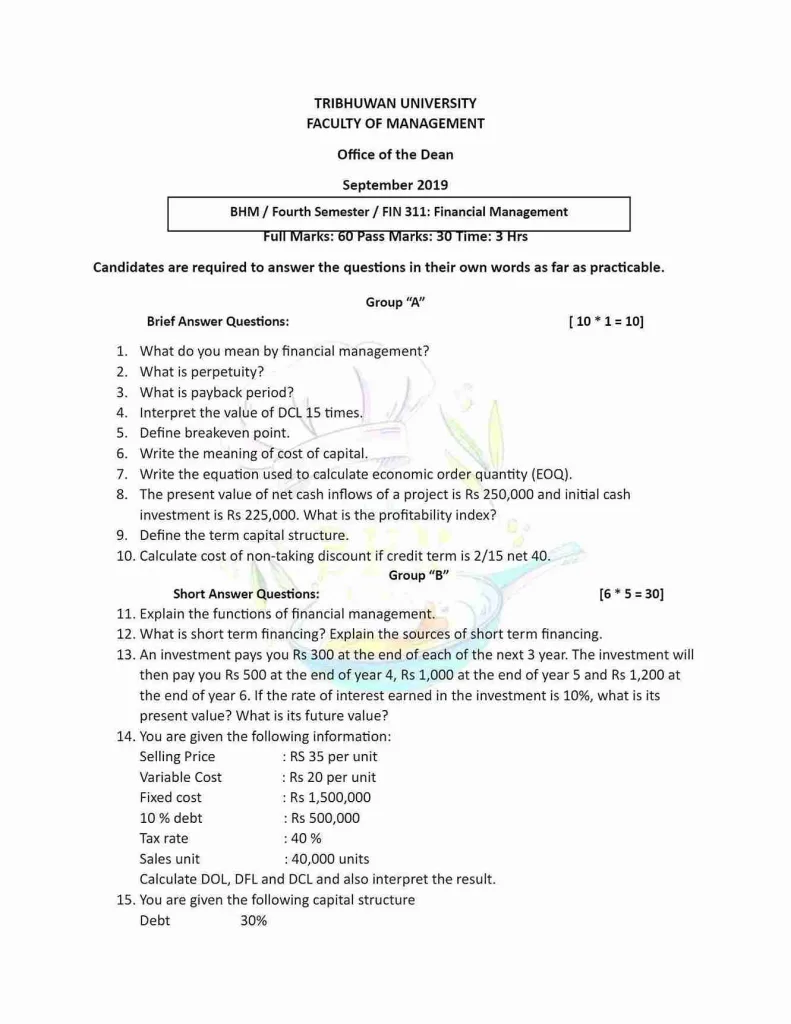

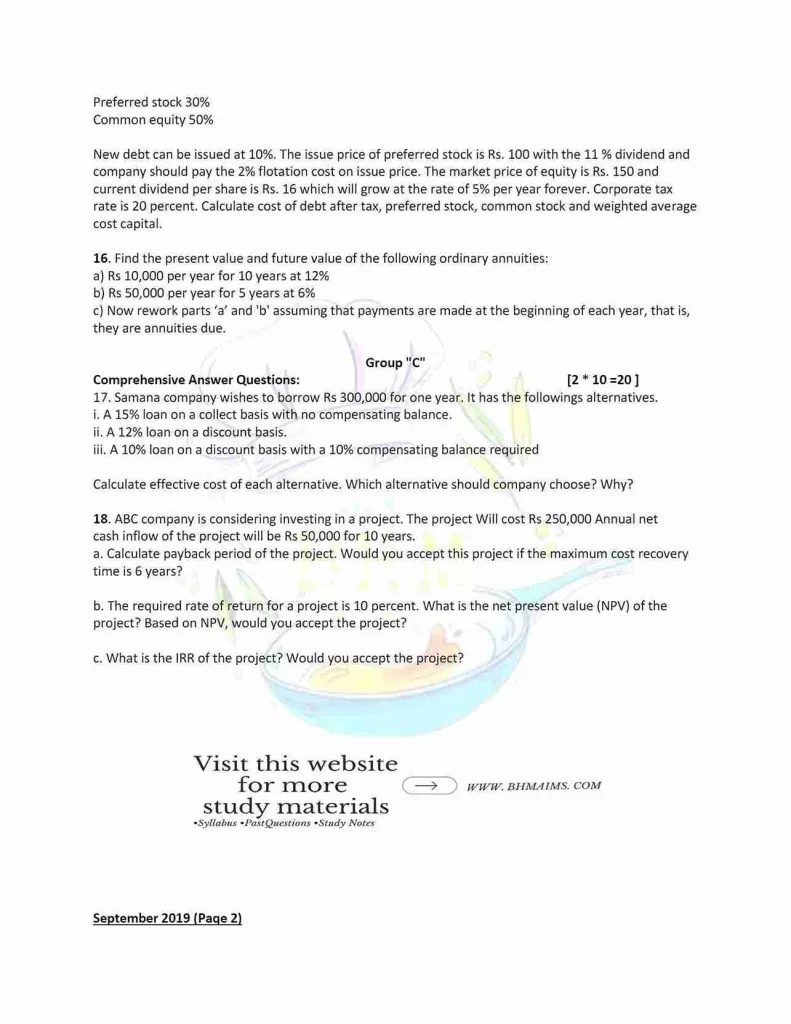

Financial Management Year 2019 Question Paper

NOTE: Question 14 (Year 2019) has mistake in question. Fixed cost should be Rs 1,50,000

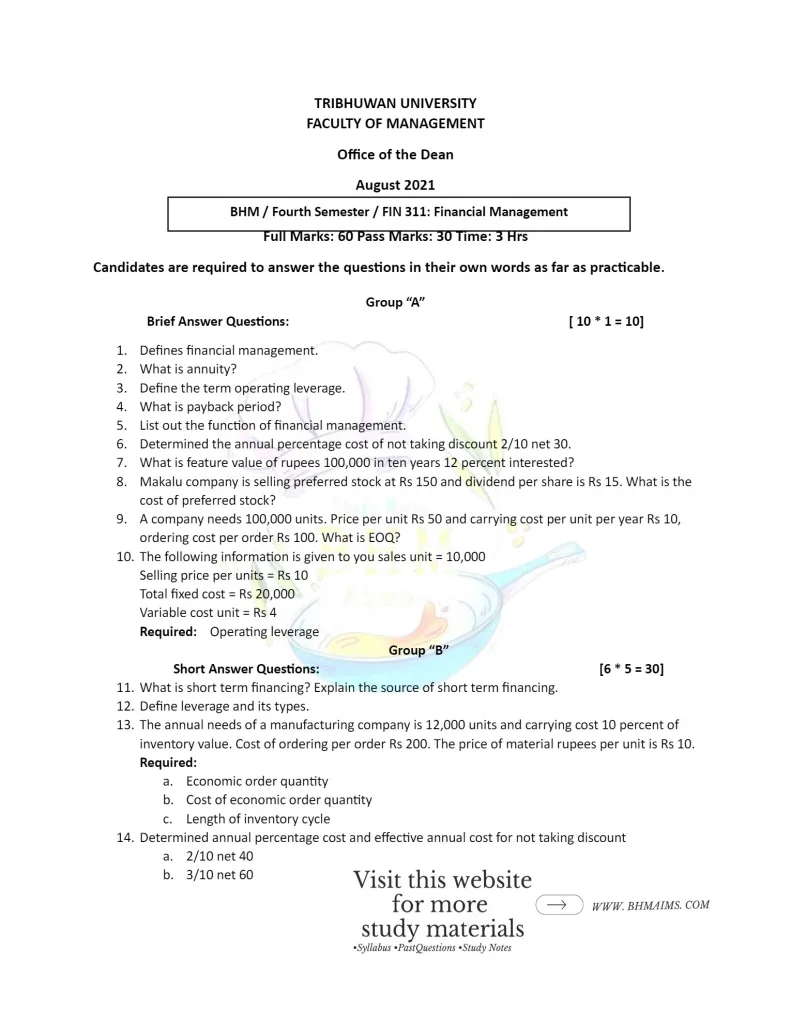

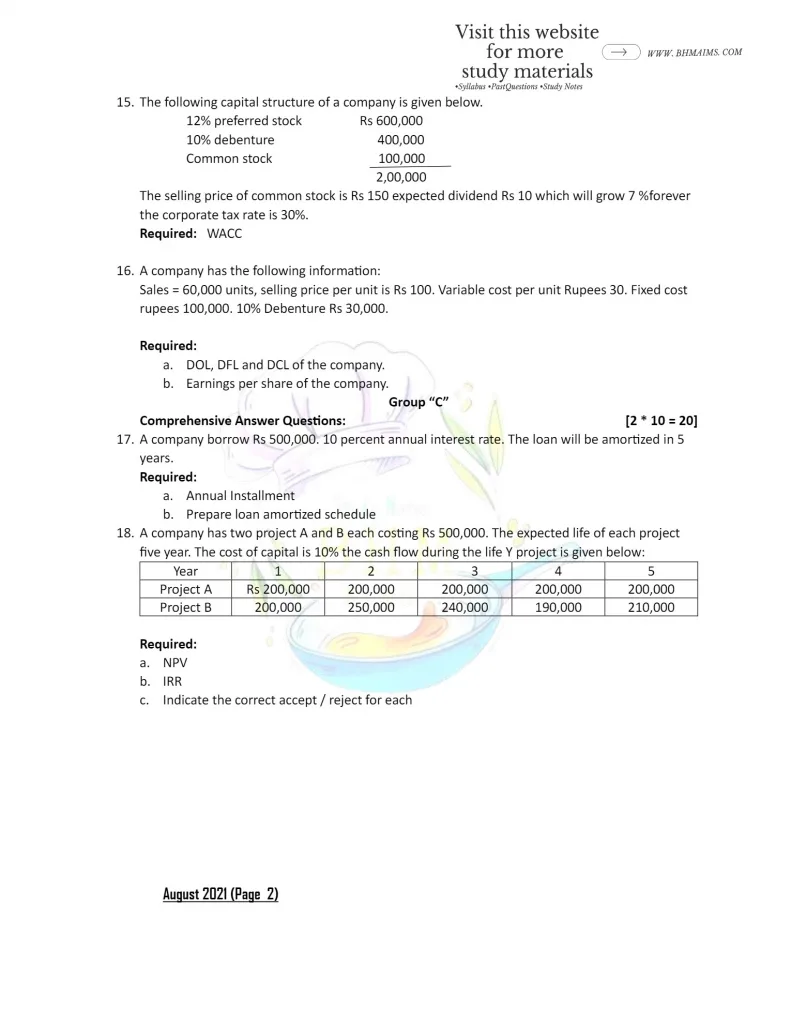

Financial Management Year 2021 Question Paper

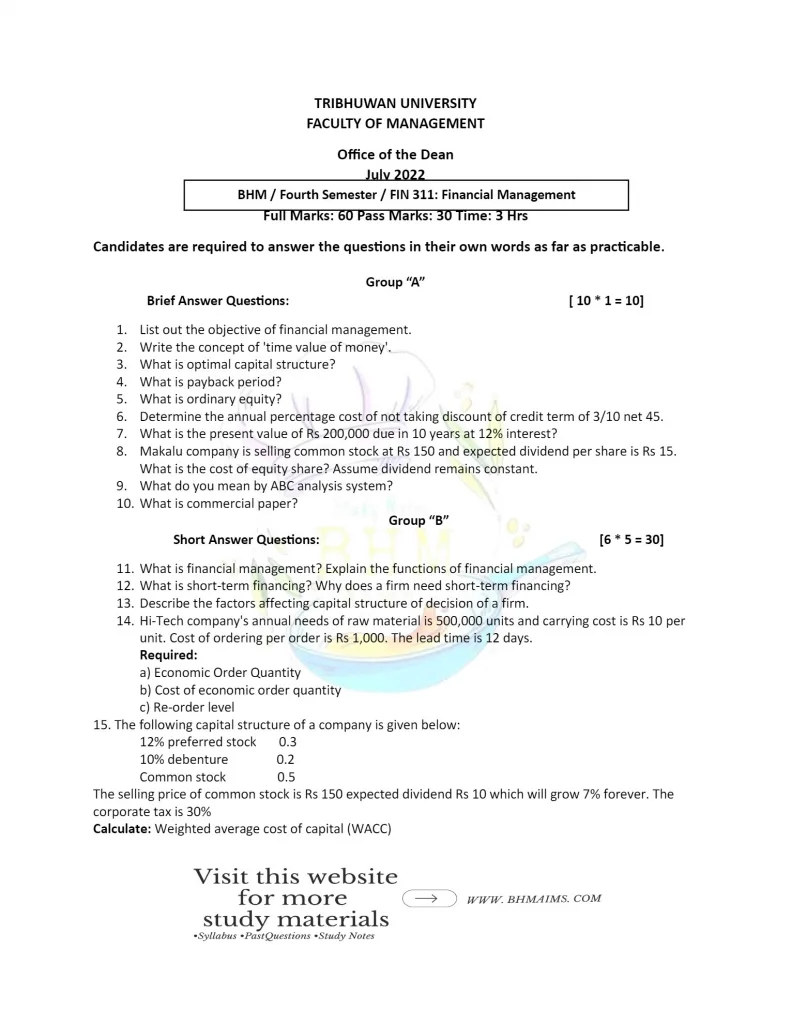

Financial Management Year 2022 Question Paper

Financial Management Year 2023 Question Paper

Solved Solutions

Solution of Year 2016

- In financial management, leverage is the utilization of borrowed capital, such as loans or debt financing, alongside equity, to potentially amplify returns on investment, while simultaneously increasing the risk associated with the investment due to the obligation to repay the borrowed funds with interest.

OR,

Simply in other words, leverage means using borrowed money, like loans, to increase potential profits, but it also increases the risk because you have to pay back the borrowed money with interest.

OR,

Leverage can be defined as an attempt to increase the return rate of ownership capital with maximum using low interest rate borrowed capital. - An ordinary annuity makes payments at the end of each period, while an annuity due makes payments at the beginning of each period.

- Inventory management is balancing act that has to be performed to ensure that neither too little nor too much inventory is help for minimizing the cost for ordering and holding of inventory.

- Cost of capital is the return expected by the providers of capital (i.e. shareholders, lenders, and the debt-holders) to the business as a compensation for their contribution to the total capital.

- The difference between total present value and net investment is known as Net Present Value (NPV). NPV can be determine as follow:

NPV = Total present value of cash inflows – NCO - Investment decision in financial management refers to the process of identifying, evaluating, and selecting investment opportunities that align with the goals and objectives of an organization or individual, considering factors such as risk, return, and liquidity.

- Solution

Given,

Par Value = Rs 100

Selling Price (np) = Rs 150

Dividend Per Share (D)= 15

We know,

Cost of Preferred Stock (Ks) = D / np

= 15 / 150

= 0.1

= 0.1 * 100 %

= 10 %

(Note : Percentage मा answer निकाल्न * 100% गरेको )

- Solution

Present Value (PV) = ?

Future Value (FV) = Rs 500

Interest Rate (i) = 10%

Time (n) = 5 years

We know,

FV = PV (1 + i)n

or, 500 = PV (1 + 0.10)5

or, PV= Rs. 310.46

Hence, the present value is Rs 310.46.

Or, We can also calculate it by tabulation method:

PV = FV * PVIFi,n

or, PV = 500* PVIF10,5

or, PV = 500* 0.6209

or, PV = 310.45

- Solution

Given,

Discount (DR) = 2 %

Discount period (DP) = 10 days

Credit Period (CP) = 40 days

We know,

Annual Percentage Cost (APC) =( DR / 100-DR ) * (365 / CP -DP)

=( 2 / 100-2 ) * (365 / 40 -10)

= 24.82 %

- Solution

Annual Requirement = 5,000 units

Unit Cost = Rs 400

Carrying Cost = 25 %

= 25 % of Rs 400

= (25 * 400 )/ 100

= Rs 100

Cost of placing order = Rs 2,500

We know,

Economic Order Quantity i.e. EOQ = √(2AO / C)

= √(2* 5,000 * 2,500) / 100

= 500 Units

- Financial management involves planning, organizing, directing, and controlling an organization’s financial resources to achieve its objectives efficiently and effectively, encompassing activities such as budgeting, investment decision-making, and financial analysis.

The functions of financial management are:

a. Helps increase the value of firm / business

b. Helps proper use of funds

c. Helps deciding right sources of financing

d. Helps making dividend decision

e. Helps to improve profitability

f. Apply financial controls in the organization - The capital which is required for operating day to day business activities is called working capital.

Net working capital refers to the difference between a company’s current assets and current liabilities, representing the amount of capital available for day-to-day operations. It is a measure of a company’s liquidity and ability to meet short-term financial obligations.

The importance of working capital management are listed below:

a. Liquidity management: It ensures there’s enough cash to cover day-to-day operations and unexpected expenses, preventing financial crunches.

b. Optimizing resource utilization: By efficiently managing assets and liabilities, companies can maximize their return on investment and minimize costs.

c. Cash flow management: It involves monitoring the inflow and outflow of cash to ensure the business always has enough funds to meet its obligations.

d. Risk reduction: Effective working capital management helps mitigate financial risks associated with market fluctuations, economic downturns, and unexpected events.

e. Supplier relationship management: Maintaining good relationships with suppliers can lead to favorable credit terms and discounts, helping to preserve working capital.

f. Facilitating business growth: Proper management of working capital ensures that the business has the financial flexibility to seize growth opportunities and expand operations when needed.

- Solution:

Annual Requirement (A) = 10,000 units

Ordering cost per order (O) = Rs 100

Annual carrying cost (C) = Rs 2 per unit

Lead time = 9 days

We know,

a. Economic Order Quantity i.e. EOQ = √(2AO / C)

= √ (2 * 10,000 * 100) / 2

= 1,000 units

b. Total cost at EOQ = √2AOC

= √ 2 * 10,000 * 100 * 2

= Rs 2,000

c. Re-order Level (ROL) = Maximum consumption * Lead time

= 10,000 * 9

= 90,000 units

- Solution

Sub- Question (a)

Given,

Discount (DR) = 2 %

Discount period (DP) = 10 days

Credit Period (CP) = 30 days

We know,

Annual Percentage Cost (APC) =( DR / 100-DR ) * (365 / CP -DP)

=( 2 / 100-2 ) * (365 / 30 -10)

= 37.24 %

Effective Annualized Cost (EAIR) = {1 + (DR / 100- DR)^(365/CP-DP) -1 ]

= {1 + (2 / 100- 2)^(365/30-20) -1 ]

= 44.58 %

Sub- Question (b)

Given,

Discount (DR) = 3 %

Discount period (DP) = 20 days

Credit Period (CP) = 50 days

We know,

Annual Percentage Cost (APC) =( DR / 100-DR ) * (365 / CP -DP)

=( 3 / 100-3 ) * (365 / 50 -20)

= 37.67 %

Effective Annualized Cost (EAIR) = {1 + (DR / 100- DR)^(365/CP-DP) -1 ]

= {1 + (2 / 100- 3)^(365/50-20) -1 ]

= 44.85 %

- Solution:

Cost of debt after tax (Kdt)

= Kd (1-t)

= 10(1-0.40)

=6%

Where,

Kd= Cost of debt before tax

t= tax rate

Cost of Preference Share (Kps)

= Dps / NP

= 12 / 100

= 0.12

= 0.12 * 100 %

= 12%

(Note : Percentage मा answer निकाल्न * 100% गरेको )

Where,

Dps = Dividend of preference share

NP= Net proceed

Cost of common equity (Ke)

= (D1/ P0 ) + g

=[ (12/120) 100%] + 5%

= 15%

Where, D1 = Dividend expected

P0 = Current Market price of equity

Calculation of WACC

| Source | Proportion (p) | Cost (k) | P * K |

|---|---|---|---|

| Debt | 0.40 | 6 | 2.4 |

| Preference Share | 0.10 | 12 | 1.2 |

| Common Equity | 0.50 | 15 | 7.5 |

| Total | 1 | 33 | 11.1 |

Hence, overall cost of capital = 11.1%

- Solution:

Income Statement

| Particulars | Amount (Rs) |

| Sales Revenue (Sales unit * Selling Price per unit i.e. SPPU) Less: Variable Cost (Sales unit * Variable cost per unit i.e. VCPU) Contribution Margin Less: Fixed Cost Earning before Interest and Tax (EBIT) / Operating profit Less: Interest (10%) Earning before tax | 50,000 (500,000) 5,00,000 (1,50,000) 3,50,000 50,000 3,00,000 |

Now,

Degree of Operating Leverage (DOL)= Contribution Margin / EBIT

= 5,00,000 / 3,50,000

= 1.42 times

Degree of Financial Leverage (DFL) = EBIT / EBT

= 3,50,000 / 3,00,000

= 1.16 times

Degree of Combined Leverage (DCL) = DOL * DFL

= 1.42 * 1.16

= 1.64

- Solution:

Cost of Plan = Rs 10,00,000

Installation Cost = Rs 1,00,000

Annual Net Cashflow = Rs 4,00,000

Line of Project = 5 Years

Cost of Capital = 10 %

Now,

a. Net investment at beginning i.e. NCO = Cost of Plan + Installation cost

= 10,00,000 + 1,00,000

= Rs 11,00,000

b. Payback Period (PBP) = NCO / Annual cashflow

= 11,00,000 / 4,00,000

= 2.75 Years

C. Calculation of NPV

| Year | Cashflow | PVIA @ 10 % | PV |

|---|---|---|---|

| 0 | (1100000) | 1 | (1100000) |

| 1 – 5 | 400000 | 3.7908 | 1516320 |

| NPV = 1100000 – 1516320 = 416320 |

d. Since, the NPV is positive, We would accept the project.

- Solution

Present value of annuity (PVA) = RS 15,000

Annual interest rate (i) = 10 %

Time (n) = 5 years

We know,

PVA = PMT * PVIFAi,n

or, 15,000= PMT* PVIFA10,5

or, PMT = 15,000 / 3.7908

or, PMT = Rs 3956.94

Loan Amortization Schedule

| Year | Beginning amount (1) | Payment or PMT (2) | Interest (@10%) | Repayment of principle (4)= 2-3 | Ending balance (5)= 1 -4 |

|---|---|---|---|---|---|

| 1 | 15,000 | 3956.94 | 1500 | 2456.94 | 12532.06 |

| 2 | 12532.06 | 3956.94 | 1254.30 | 2702.64 | 9840.42 |

| 3 | 9840.42 | 3956.94 | 984.04 | 2972.9 | 6867.52 |

| 4 | 6867.52 | 3956.94 | 686.75 | 3270.19 | 3597.33 |

| 5 | 3597.33 | 3956.94 | 359.73 | 3597.20 | 0 |

The rounding effect is Rs. 360.13.

NOTE FOR UNDERSTANDING ONLY : While we calculate this we don’t write some decimal points, so during calculation is slight difference in final answer, but we can write it as rounding effect and write 0 in last.

Tips: The final value as ending balance must be zero.

Solution of Year 2017

- Operating leverage refers to the extent to which a company’s fixed costs affect its net income when there are changes in its sales revenue. Essentially, it measures the sensitivity of a company’s operating income (or EBIT – Earnings Before Interest and Taxes) to changes in sales volume

OR,

Simply, Operating leverage refers to the impact that fixed costs have on a company’s profitability, meaning that small changes in sales can result in larger changes in operating income. - Annuities is a series of equal cash flow (payment) at specific period of a time.

An annuity is an financial product that pays out a fixed stream of payments to an individuals, and these financial products are primarily used as an income stream for retirees.

- Short term financing means all those liabilities or obligation that are originally scheduled for repayment in one year or less than one year.

- Payback period means investment return time. It is also called payout or pay off period.

Payback period is the number of years required to recover the original cash outlay. - Repeated from Year 2021, Question Number 1 (Please refer back to that year)

- Solution:

Annual Requirement (A) = 12,000 units

Ordering cost per order (O) = Rs 200

Annual carrying cost (C) = Rs 1.20 per unit

In question carrying cost is given as rent, tax and insurance which means same thing.

We know,

a. Economic Order Quantity i.e. EOQ = √(2AO / C)

= √ (2 * 12,000 * 200) / 1.20

= 2,000 units

- Solution:

As per given information,

Sales = Rs 50,000

Variable Cost (V.c.) = Rs 20,000

Fixed Cost (F.c.) = Rs. 20,000

We know that,

Degree of Operating Leverage (DOL) = Contribution Margin / EBIT

= (Sales – Variable Cost) / (Sales – Variable cost – Fixed Cost )

= (50,000 – 20,000) / (50,000 – 20,000 – 20,000)

= 3 times

- Solution:

Present Value (PV) = Rs 500

Time (n) = 5 year

Interest rate (i) = 10 %

We know,

PV = FV * PVIFi,n

or, 500 = FV * PVIF10,5

or , 500 = FV * 0.6209

or FV = RS 805.25

Or we can also calculate it by using another formula / method:

FV = PV (1 + i)n

or, FV = 500(1 + 0.10)5

or, FV = Rs 805.25

NOTE: You can use any method.

- Solution

Given,

Discount (DR) = 2 %

Discount period (DP) = 10 days

Credit Period (CP) = 30 days

We know,

Annual Percentage Cost (APC) =( DR / 100-DR ) * (365 / CP -DP)

=( 2 / 100-2 ) * (365 / 30 -10)

= 37.24 %

- Solution:

Current Selling Equity Share (P0) = Rs 125

Expected Dividend per share (D1) = Rs 20

Growth Rate (g) = 7 %

We know,

Cost of equity =( D1 / P0 ) + g

= (20 / 125 )+ 7 %

= 0.16 + 7 %

= 0.16 * 100 % + 7 % (Note: Percentage मा लानु पर्ने भएर * 100 % गरेको)

= 16 % + 7 %

= 23 %

- The average cost of the costs of various sources of financing is known as Weighted Average Cost of Capital (WACC). It is also called as composite cost of capital, overall cost of capital, average cost of capital and combined cost of debt and equity capital.

Once the specific cost of different source of finance is determined, the overall capital is then determined by weight considering the proportion of the various sources of funds to the total.

The following steps are used in the calculation of overall cost of capital (K0).

| Step 1 | To find out the cost of each type of capital by using different related formula. |

| Step 2 | To assign weight or proportion or ratio of each component. |

| Step 3 | Multiply each cost of capital by assigned weight. |

| Step 4 | To ascertain overall cost of capital by adding the products of step 3. |

Symbolically, the above steps can be presented as follows:

K0 = [Kd * Wd + Kp * Wp + Ke * We + Kr * Wr]

where,

K0 = Overall Cost of capital

Kd = Cost of debt capital, after tax

Wd = Weight or proportion of debt capital

Kp = Cost of preference capital

Wp= Weight or proportion of preference capital

Ke = Cost of equity Capital

We = Weight or proportion of preference capital

Kr = Cost of retained earnings

Wr = Weight or proportion of retained earnings

Format:

| Sources | Amount (Rs) | Proportion (P) | Cost (K) | P * K |

|---|---|---|---|---|

| Debentures | ||||

| Preference stock | ||||

| Equity Share |

- Solution:

Economic Order Quantity (EOQ) = 2,000 units

Annual Sales, which can be called as Annual requirement (A) = 2,000 units

Ordering cost per order (O) = Rs 300

Annual carrying cost (C) = ?

We know,

a. Economic Order Quantity i.e. EOQ = √(2AO / C)

or, 2,000 = √ (2 * 10,000 * 300) / C

Taking square on both sides to cancel out square root (√)

or (2,000)2 = (2 * 10,000 * 300) / C

or, 40,00,000 C = 60,00,000

or, C= 60,00,000 / 40,00,000

or, C = Rs 1.5

Hence Carrying cost is Rs 1.5

Yearly Minimum total cost = √(2AO C)

= √2 * 10,000 * 300 * 1.5

= Rs 3,000

- Solution

Sub- Question (a)

Given,

Discount (DR) = 2 %

Discount period (DP) = 10 days

Credit Period (CP) = 40 days

We know,

Annual Percentage Cost (APC) =( DR / 100-DR ) * (365 / CP -DP)

=( 2 / 100-2 ) * (365 / 40 -10)

= 24.82 %

Effective Annualized Cost (EAIR) = {1 + (DR / 100- DR)^(365/CP-DP) -1 ]

= {1 + (2 / 100- 2)^(365/40-10) -1 ]

= 27.86 %

Sub- Question (b)

Given,

Discount (DR) = 3 %

Discount period (DP) = 20 days

Credit Period (CP) = 60 days

We know,

Annual Percentage Cost (APC) =( DR / 100-DR ) * (365 / CP -DP)

=( 3 / 100-3 ) * (365 / 60 -20)

= 28.22 %

Effective Annualized Cost (EAIR) = {1 + (DR / 100- DR)^(365/CP-DP) -1 ]

= {1 + (3 / 100- 3)^(365/60-20) -1 ]

= 32.04 %

- Solution

Cost of debt after tax (Kdt)

= Kd (1-t)

= 10(1-0.40)

=6%

Where,

Kd= Cost of debt before tax

t= tax rate

Cost of Preference Share (Kps)

= 12%

Next,

Cost of common equity (Ke)

= (D1/ P0 ) + g

=(15/150) + 5%

= 15%

Where, D1 = Dividend expected

P0 = Current Market price of equity

Computation of Weighted Average Cost of Capital

| Source | Amount | Proportion (p) | Cost (k) | P * K |

|---|---|---|---|---|

| Debt | 1,00,000 | 0.166 | 6 | 0.996 |

| Preference Share | 2,00,000 | 0.33 | 12 | 7.5 |

| Common Equity | 3,00,000 | 0.5 | 15 | 3.96 |

| Total | 6,00,000 | 1 | 33 | 12.456 |

Hence, overall weight of cost of capital (WACC) is 12.46%.

- Solution

(Before we did solution by making income statement in Year 2016, but as we can do it without making income statement also, lets try this new approach). However, we suggest you to make income statement in exam as it is much easy to look, but it wont be wrong if you go with below approach also)

Given information:

Sales Unit = 4,000

Selling Price Per Unit (SPPU) = Rs 100

Variable Cost (VCPU) = Rs 60 per unit

Fixed cost (FC) = Rs 1,20,000

Interest (I) = Rs 20,000

Before calculating main answer let us calculate:

Total Sales = Sales unit * SPPU

= 4,000 * 100

= R 4,00,000

Total Variable Cost (VC) = VCPU * Sales Unit

= Rs 60 * 4,000

= Rs 2,40,000

Now,

Degree of Operating Leverage (DOL)= Contribution Margin / EBIT

= (Sales – Variable Cost )/ (Sales – VC – FC)

= [(4,00,000 – 2,40,000)] / [(4,00,000 – 2,40,000 – 1,20,000)]

= 1,60,000/ 40,000

= 4 times

Degree of Financial Leverage (DFL) = EBIT / EBT

= 40,000 /( EBIT – Interest )

= 40,000 / (40,000 – 20,000)

= 2 times

Degree of Combined Leverage (DCL) = DOL * DFL

= 4* 2

= 8 times

- Repeated from Year 2016, Question Number 11 (Please refer back to that year )

- Solution

Sub- Question (a)

Given,

Loan (L) = Rs 1,00,000

Interest Rate(I) = 15 %

We know,

Effective Interest Rate (EIR) = (Interest / Loan) * 100%

=(15,000 / 1,00,000) * 100%

= 15 %

Sub- Question (b)

Given,

Loan (L) = Rs 1,00,000

Interest Rate(I) = 15 %

Compensating Balance (CB) = 20%

We know,

Effective Interest Rate (EIR) in simple interest loan basis = (Interest / Loan – CB)

=(15,000 / 1,00,000 – 20,000)

= 16.25 %

Or, We can also calculate this by below method:

Given,

Interest (I) = 5% = 0.5

Compensating Balance (CB) = 20% = 0.20

We know,

Effective Interest Rate (EIR) in Simple interest loan basis

= (Interest rate in fraction/ 1 – CB in fraction)

=(0.13 / 1 – 0.20)

= 16.25 %

Sub- Question (b)

Given,

Loan (L) = Rs 1,00,000

Interest Rate(I) = 15 %

Compensating Balance (CB) = 20%

We know,

Effective Interest Rate (EIR) in Discounted loan basis

= (Interest rate in fraction/ 1 – CB in fraction – interest in fraction)

=(0.11 / 0.5 – 0.11)

= 14.86 %

- Solution

Cost of Capital = Rs 30,000

Life of a Machine = 4 Years

Cost of Capital = 10 %

Note: In uneven cashflow before calculating we have to make this table first to calculate cumulative CF.

| Year | Cashflow | Cumulative CF |

|---|---|---|

| 0 | (30000) | (30,000) |

| 1 | 12,000 | (18,000) |

| 2 | 15,000 | (3,000) |

| 3 | 10,000 | 7,000 |

| 4 | 7,000 | 14,000 |

a. Payback Period (PBP) = Minimum Year + (Amount to be recovered / Cashflow for Next Year)

= 2 + (3,000/10,000)

= 2.3 Years

b. Net Present Value

| Year | Cashflow | PVIF@ 10% | PV |

|---|---|---|---|

| 0 | (30,000) | 1 | (30,000) |

| 1 | 12,000 | 0.9091 | 10909.2 |

| 2 | 15,000 | 0.8264 | 12396 |

| 3 | 10,000 | 0.7513 | 7513 |

| 4 | 7,000 | 0.6830 | 4781 |

| NPV= 5599.2 |

c. Internal Rate of Return (IRR)

Step 1: Fake annuity / Average CFAT = Sum of CFAT over Year / Number of Years

= 44,000 / 4

= 11,000

Fake Factor PBP Factor = NCO / Average CFAT

= 30,000 / 11,000

= 2.72

Step 2: Referring to PVIFA table the factor 2.72 lies between 2.7432 and 2.6901 which corresponding rate 17 % and 18 % respectively.

Step 3: Calculation of IRR (Uneven Cashflow)

| Year | CFAT (Rs) | PVIF @ 17 % | PV (Rs.) | PVIF @ 18% | PV (Rs) |

|---|---|---|---|---|---|

| 1 | 12,000 | 0.8547 | 10256.4 | 0.8475 | 10170 |

| 2 | 15,000 | 0.7305 | 10957.5 | 0.7182 | 10773 |

| 3 | 10,000 | 0.6244 | 6244 | 0.6086 | 6086 |

| 4 | 7,000 | 0.5337 | 3735.9 | 0.5158 | 3610.6 |

| TPV | 31193.8 | 30639.6 |

Now,

IRR = LR + [(TPVLR – NCO)/ (TPVLR – TPVHR)]* (HR-LR)

=17 + [(31193.8 – 30,000)/ (31193.8- 30639.6)]* (18-17)

= 17 + [31193.8 / 554.2]* (18-17)

= 17 + 56.28 * 1

=73.28 %

Solution of Year 2018

- Financial management is the scope of management that involves planning, organizing, directing, and controlling an organization’s financial resources to achieve its objectives efficiently and effectively, encompassing activities such as budgeting, investment decision-making, and financial analysis.

- An ordinary annuity refers to a series of equal payments made at regular intervals over a specified period of time.

- Repeated from Year 2016, Question Number 11 (Please refer back to that year)

- Capital Structure refers to the proportions or combinations of equity share capital, preference share capital, debentures, long-term loans, retained earnings and other long-term sources of funds in the total amount of capital which a firm should raise to run its business.

- Repeated From Year 2016, Question Number 5 (Please refer back to that Year)

- Solution

Given,

Discount (DR) = 3 %

Discount period (DP) = 15 days

Credit Period (CP) = 45 days

We know,

Annual Percentage Cost (APC) =( DR / 100-DR ) * (365 / CP -DP)

=( 3 / 100-3 ) * (365 / 45 -15)

= 37.62 %

- Solution:

Future Value (FV) = Rs 15,000

Time (n) = 10 year

Interest rate (i) = 12 %

We know,

PV = FV * PVIFi,n

or, 15,000 = FV * PVIF12,10

or , 15,000 = FV * 0.3220

or FV = RS 4830 - Solution:

Current Market or Selling Price ( P0 )= Rs 120

Dividend per share (D) = Rs 12

We know,

Cost of Preference stock (Kps)= D / P0

= 12 / 120

= 0.1

= 0.1 * 100 %

= 10 % - Solution

Annual Sales = 2,00,000

Variable Cost (VC)= Rs 1,50,000

Fixed cost (Rs) = Rs 20,000

We know,

Contribution Margin = Sales – Variable cost

= 2,00,000 – 150,000

= Rs 50,000

EBIT = Sales – VC -FC

= 2,00,000 – 150,000 – 20,000

= Rs 30,000

Now,

Degree of operating Leverage (DOL) = CM / EBIT

= 50,000 / 30,000

= 1.66 times

- Solution:

Annual Requirement (A) = 500,000 units

Ordering cost per order (O) = Rs 2,500

Annual carrying cost (C) = Rs 50

We know,

a. Economic Order Quantity i.e. EOQ = √(2AO / C)

= √ (2 * 500,000 * 2500) / 50

= 7072 units

- Short term financing means all those liabilities or obligation that are originally scheduled for repayment in one year or less than one year.

The sources of short term financing are as follow:

a. Trade Credit: Trade credit is a short term unsecure spontaneous sources of finance. It is happen when one firm buys on credit from other firms. Trade credit refers to credit that a gets from its suppliers of goods or suppliers on accounts, that is without making intermediate cash payments.

b. Short term Bank Loan: Short term bank loan is a major source of unsecured sources of financing. Accruals and trade credit are spontaneous in nature; short term bank loan is non-spontaneous in nature. It appears on balance sheet as notes payable. Commercial banks provide different types of unsecured short-term credit such as transactional loan, line of credit, and revolving credit agreement.

c. Commercial Paper: Commercial paper is unsecured negotiable promissory note issued by well known corporations to short term fund for short term investment. It is money market instruments issue or sold on discount basis either placed directly or through dealers, s0 the firm receive issue or sold on discount basis either placed directly or through dealers, so the firm receives less than states face value. Maturity of commercial paper is varying from few days to maximum 270 days.

d. Bankers Acceptance: It is negotiable money market instruments issued by bank as a promissory draft and accepted by foreign bank. It is used for domestic as well as international trade to safety on banking transactions.

- Agency problem exist among shareholders and creditors when managers take decision on the behalf of shareholder to maximize shareholder wealth and ignoring the interest of creditors. Here creditors are the principal and shareholders are agent in their agency relationship.

Creditors are provide debt capital to the firm at fixed rate of interest for specific period of time and the corporation use it for a given period of time according to pre-agreed terms and conditions. Creditors do not have any role in corporation decision making. Creditors and shareholders both claim on assets and earnings of the company nit creditors get priority for receiving fixed interest and principal according to specific period of time. If corporation management invest in risky project, becomes if it is successful all benefits goes to shareholders because creditors will received pre-fixed returns. However if the project is unsuccessful creditor may be bearing some losses. The managers buy back the share by borrowing funds to increase debt, in such situation all benefit goes to shareholder but risk also bearing by creditors.

To solve the conflict among creditors and shareholders following mechanism are explained below:

a. Providing compensation to creditors

b. Proactive terms and conditions

- Solution:

Annual Sales or Requirement (A) = 420,000 units

Purchase Price Per Unit (O) = Rs Rs 5

Carrying cost (C) = 20% of 5

= Rs 1

Desired Safety Stock = 13,200 units

Lead Time = 2 Weeks

We know,

a. Economic Order Quantity i.e. EOQ = √(2AO / C)

= √ (2 * 420,000 * 5) / 1

= 2049 units

b. ROL = Safety Stock + (Daily Consumption * Lead Time)

- Solution

Sub- Question (a)

Given,

Discount (DR) = 2 %

Discount period (DP) = 10 days

Credit Period (CP) = 30 days

We know,

Annual Percentage Cost (APC) =( DR / 100-DR ) * (365 / CP -DP)

=( 2 / 100-2 ) * (365 / 30 -10)

= 37.24%

Effective Annualized Cost (EAIR) = {1 + (DR / 100- DR)^(365/CP-DP) -1 ]

= {1 + (2 / 100- 2)^(365/30-20) -1 ]

= 44.58%

Sub- Question (b)

Given,

Discount (DR) = 3 %

Discount period (DP) = 15 days

Credit Period (CP) = 45 days

We know,

Annual Percentage Cost (APC) =( DR / 100-DR ) * (365 / CP -DP)

=( 3 / 100-3 ) * (365 / 45 -15)

= 37.62%

Effective Annualized Cost (EAIR) = {1 + (DR / 100- DR)^(365/CP-DP) -1 ]

= {1 + (3 / 100- 3)^(365/45-15) -1 ]

= 44.85%

- Solution:

We know that,

Degree of Operating Leverage (DOL) = Contribution Margin / EBIT

= (Sales – Variable Cost) / (Sales – Variable cost – Fixed Cost )

= (600,000 – 200,000) / 300,000

= 4,00,000 / 3,00,000

= 1.33 time

Degree of Financial Leverage (DFL) = EBIT / EBT

= 3,00,000 / 2,50,000

= 1.2 time

Degree of Combined Leverage (DCL) = DOL * DFL

= 1.2 * 1.33

= 1.596 time

- Solution:

For Truck:

a. Calculation of NPV

| Year | Cashflow | PVIFA @ 14% | PV |

|---|---|---|---|

| 0 | (17,000) | 1 | (17,000) |

| 1-5 | 5,000 | 3.4331 | 17165.5 |

| NPV= 17165.5- 17000 = 165.5 |

b. Calculation of IRR

Step 1: Fake Factor / PBP Factor = NCO / Annual CFAT

= 17000 / 5000

= 3.4

Step 2: Referring to PVIFA table the factor 3.4 lies between 3.4331 and 3.3522 which corresponding rate 14 % and 15 % respectively.

In even Cashflow,

IRR = LR + [(LR Factor – Calculated Factor / LR Factor – HR Factor)] * (HR – LR)

= 14 + [(3.4331 – 3.4 / 3.4331 – 3.3522 )]*( 15 – 14)

= 14.40 %

For Pulley System

a. Calculation of NPV

| Year | Cashflow | PVIFA @ 14% | PV |

|---|---|---|---|

| 0 | (23,000) | 1 | (23,000) |

| 1-5 | 7,600 | 3.4331 | 26091.56 |

| NPV=3091.56 |

b. Calculation of IRR

Step 1: Fake Factor / PBP Factor = NCO / Annual CFAT

= 23000 / 7600

= 3.0263

Step 2: Referring to PVIFA table the factor 3.0263 lies between 2.9906 and 3.0576 which corresponding rate 20 % and 19% respectively.

In even Cashflow,

IRR = LR + [(LR Factor – Calculated Factor / LR Factor – HR Factor)] * (HR – LR)

= 19 + [(3.0576 – 3.0263 / 3.0576 – 2.9906 )]*( 20 – 19)

= 19.5 %

Since, both truck and pulley system have positive NPV, in not mutually inclusive project, we will accept both project; but if it was asked mutually inclusive project in question then we would accept pulley system as it has higher NPV and IRR

Solution of Year 2019

- Repeated Question

- A perpetuity is a security that pays for an infinite amount of time. In finance, perpetuity is a constant stream of identical cashflows with no end. Perpetuity cashflow has not fixed maturity period.

- Repeated

- A DCL of 15 times means that for every small change in sales, the impact on operating income is 15 times larger, showing that the company’s profitability is highly sensitive to changes in sales volume.

OR,

The degree of combined leverage (DCL) value of “15” suggests that for every 1% increase in sales, the Earnings Before Taxes (EBT) would increase by 15%. Therefore, if sales increase by 20%, the EBT would increase by 20 times 15%, resulting in a 300% increase in EBT. - The breakeven point is the level of sales at which total revenue equals total costs, resulting in neither profit nor loss. It’s the point where the company covers all its expenses and starts generating profit beyond that level of sales.

- Cost of capital is the return expected by the providers of capital (i.e. shareholders, lenders and the debt-holders) to the business as a compensation for their contribution to the total capital.

OR,

The cost of capital can be defined as the rate of return that a firm must generate from its investments in order to maintain or increase its market value. - The equation used to calculate EOQ is:

EOQ= √ (2 AO/ C)

√ means square root

A = Annual requirement or used

O = Ordering cost or Procurement Cost or Setup Cost

C = Carrying cost or Holding Cost - Solution

Present value = Rs 2,50,000

Initial investment = Rs 2,25,000

We know,

Profitability index = Total present value / Initial cost

= 2,50,000 / 2,25,000

= 1.11

- Solution

Given,

Discount (DR) = 2 %

Discount period (DP) = 15 days

Credit Period (CP) = 40 days

We know,

Annual Percentage Cost (APC) =( DR / 100-DR ) * (365 / CP -DP)

=( 2 / 100-2 ) * (365 / 40 -15)

= 29.79%

- Solution:

Annual Requirement (A) = 5,000 units

Cost of placing order (O) = Rs 2,500

Annual carrying cost (C) = 25 % = 25 % of 400 = Rs 100

We know,

a. Economic Order Quantity i.e. EOQ = √(2AO / C)

= √ (2 * 5,000 * 2500) / 100

= 500 units

- Repeated question from year 2016, Question number 11 (please refer back to that year)

- Repeated question from year 2018, question number 11 (please refer back to that year)

- Solution

PV= CF1 / (1 + i)1 + CF2 / (1 + i)2 + CF3 / (1 + i)3 + CF4 / (1 + i)4 + CF5 / (1 + i)5 + CF6 / (1 + i)6

= 300/ (1 + 0.10)1 + 300/ (1 + 0.10)2 + 300/ (1 + 0.10)3 + 500 / (1 + 0.10)4 + 1000/ (1 + 0.10)5 + 1200 / (1 + 0.10)6

= 272.72 + 247.93 + 225.39 + 341.50 + 620.92 + 677.36

= Rs 2385.82

FV = CF1 (1+i)n-1 + CF2 (1+i)n-2 + CF3 (1+i)n-3 + CF4 (1+i)n-4 + CF5 (1+i)n-5 + CF6 (1+i)n-6

= 300 (1+0.10)6-1 + 300(1+0.10)6-2 + 300(1+0.10)6-3 + 500(1+0.10)6-4 + 1000 (1+0.10)6-5 + 1200(1+0.10)6-6

=483.153 + 439.23 + 399.3 + 605 + 1100 + 1200

= 4226.683

- Solution

Income Statement

| Particulars | Amount |

|---|---|

| Sales (35 * 40,000) | 14,00,000 |

| Less: Variable Cost (20 * 40,000) | (8,00,000) |

| Contribution Margin | 6,00,000 |

| Less: Fixed Cost | (1,50,000) |

| Earning before Interest and Tax (EBIT) | 4,50,000 |

| Less: Interest | (50,000) |

| Earning before Tax (EBT) | 4,00,000 |

| Less: Tax (40 % on 4,00,000) | (1,60,000) |

| EAT / Net Income | 2,40,000 |

We know,

Degree of Operating Leverage (DOL) = Contribution Margin / EBIT

= 600000 / 450000

= 1.33 times

Degree of Financial Leverage (DFL) = EBIT / EBT

= 450000 / 400000

= 1.12 times

Degree of Combined Leverage (DCL)= DOL * DFL

= 1.33 * 1.12

= 1.48 times

- Solution

Cost of debt after tax (Kdt)

= Kd (1-t)

= 10(1-0.20)

=8%

Where,

Kd= Cost of debt before tax

t= tax rate

Cost of Preference Share (Kps)

= Dps / ( NP- Flotation cost )

= 11 / (100-2)

= 0.1122

=0.1122 * 100 % (Note: Multiplied by 100 to convert into percentage)

= 11.22%

Where,

Dps = Dividend of preference share

NP= Net proceed

Next,

We need to calculate D1 firstly,

D1 = D0 (1 + g)

= 16 (1 + 0.50)

= 24

Cost of common equity (Ke)

= (D1/ P0 ) + g

=(21/150) + 5%

= (0.14 * 100 % )+ 5 %

= 19%

Where, D1 = Dividend expected

P0 = Current Market price of equity

Computation of Weighted Average Cost of Capital

| Source | Proportion (p) | Cost (k) | P * K |

|---|---|---|---|

| Debt | 0.30 | 8 | 2.40 |

| Preference Share | 0.30 | 11.22 | 3.360 |

| Common Equity | 0.50 | 19 | 9.5 |

| Total | 1.1 | 38.22 | 15.26 |

Hence, overall Weight average capital = 15.26 %

- Solution

a. Solution

PVA = PMT * PVIFA i, n

= 10,000 * PVIFA12%,10

= 10,000 * 5.6502

= Rs 56502

FVA = PMT * FVIFA i, n

= 10,000 * FVIFA12%, 10

= 10,000 * 17.5487

= Rs 1,75,487

b. Solution

PVA = PMT * PVIFA i, n

= 50,000 * PVIFA6%,5

= 50,000 * 4.3295

= Rs 2,16,475

FVA = PMT * FVIFA i, n

= 50,000 * FVIFA12%, 10

= 50,000 * 17.5487

= 877435

c. Solution

a.

PVAdue = PMT * PVIFA i, n (1 + i)

= 10,000 * PVIFA12%,10 (1 + 0.12)

= 10,000 * 5.6502 (1 + 0.12)

= Rs 63282.24

FVAdue = PMT * FVIFA i, n (1 + i)

= 10,000 * FVIFA12%,10 (1 + 0.12)

= 10,000 * 17.5487 (1 + 0.12)

= Rs 196545.44

b.

PVAdue = PMT * PVIFA i, n (1 + i)

= 50,000 * PVIFA6%,5 (1 + 0.06)

= 10,000 * 4.2124 (1 + 0.06)

= Rs 210620

FVAdue = PMT * FVIFA i, n (1 + i)

= 50,000 * FVIFA6%,5 (1 + 0.06)

= 50,000 * 5.6371 (1 + 0.06)

= Rs 298766.3

- Solution

Given,

Loan = Rs 3,00,000

a. Solution

Interest amount = 15 % of loan

= (15 * 3,00,000 )/ 100

= Rs 45,000

We know,

Effective Interest Rate (EIR) = Interest / Loan

= 45,000 / 3,00,000

= 0.15

= 0.15 * 100 %

= 15 %

b. Solution

Interest amount = 12 % of 3,00,000

= (12 * 3,00,000 )/ 100

= Rs 36,000

We know,

Effective Interest Rate (EIR) = Interest / (Loan – interest)

= 36,000 / (3,00,000-36,000)

= 0.1363

= 13.63%

c. Solution

We require,

Interest =10 % of 3,00,000

= Rs 30,000

Compensating balance= 10 % of 3,00,000

= Rs 30,000

We know,

Effective Interest Rate (EIR) = Interest / (Loan – Compensating balance – Interest)

= 36,000 / (3,00,000- 30,000 -36,000)

= 0.125

= 12.5 %

- Solution

a. Calculation of Payback Period

PBP = NCO / Annual CFAT

= 2,50,000 / 50,000

= 5 Years

Since we should have recover the investment within 5 years, We would not accept the project if the maximum recovery time is 6 years. (NOTE: PBP जति थोरै तेती राम्रो, तेही भएर सबै भन्दा थोर Select गर्ने)

b. Calculation of NPV

| Year | Cashflow | PVIFA @ 14% | PV |

|---|---|---|---|

| 0 | (2,50,000) | 1 | (2,50,000) |

| 1-10 | 50,000 | 6.1446 | 307230 |

| NPV=57230 |

Since, NPV is positive, Based on NPV, We would accept the project.

C. Calculation of IRR

Step 1: Fake Factor or PBP Factor = NCO / Annual CFAT

=250,000/ 50,000

= 5

Step 2: Referring to PVFA table, the factor 5 lies between 5.0188 and 4.8332 which corresponds rate 15% and 16 % respectively.

Step 3: In even Cashflow,

IRR = LR + [(LR Factor – Calculated Factor / LR Factor – HR Factor)] * (HR – LR)

= 15 + [(5.0188 – 5/ 5.0188 – 4.8332 )]*( 16- 15)

= 15.10 %

Solution of Year 2021

- Financial Management is concerned with the collection of right amount using right sources, utilization of such fund at right place in the business.

(or)

Financial management encompasses the strategic management of an organization’s financial resources to achieve its goals and optimize its financial performance. - Annuities is a series of equal cash flow (payment) at specific period of time.

OR,

An annuity is a financial product that pays out a fixed stream of payments to an individual, and these financial products are primary used as an income stream for retirees. - Repeated from Year 2017, Question Number 1 (Please refer back to that year)

- Repeated from Year 2017, Question Number 4 (Please refer back to that year)

- Solution

Given,

Market price (P0) = Rs 150

Dividend per share (D1) = 15

We know,

Cost of preferred stock

=150 /15

=10% - Solution:

Annual Requirement (A) = 100,000 units

Ordering cost per order (O) = Rs 100

Carrying cost per unit per year (C) = Rs 10

Purchasing price per unit (PPPU) = Rs 50

We know,

a. Economic Order Quantity i.e. EOQ = √(2AO / C)

= √ (2 * 100,000 * 100) / 10

= 1414 units

- Repeated question from Year 2018, question number 11 (Please refer back to that year)

- Solution

Leverage refers to the ability of a firm in employing long term funds having a fixed cost to enhance returns to the owners.

In other words, Leverage is the amount of debt that a firm uses to finance its assets.

The types of leverage are:

a. Operating Leverage: The leverage associated with investment activities is called as operating leverage. Operating leverage may be defined as the company’s ability to use fixed operating costs to magnify the effects of changes in sakes on its earnings.

Degree of Operating Leverage is calculated by:

Degree of Operating Leverage (DOL) = Contribution Margin / EBIT

b. Financial Leverage: Financial leverage reflects the amount of debt caoital used in the capital structure of the firm. The use of the source of funds with fixed charges such as debt and preference capital with the owners equity in the capital structure is described as financial leverage.

The financial leverage measures the relationship between EBIT and Earning per share (EPS). It is also a ratio between the percentage of change on earning before tax and earing before interest and tax.

Degree of Financial Leverage is calculated by:

Degree of Financial Leverage (DFL) = EBIT / EBT

c. Combined Leverage: The combination or product of operating leverage and financial leverage is known as combined leverage. The combined leverage is also known as Composite or Total Leverage. The measures the relationship between sales and EBT (EPS).

Degree of combined leverage is calculated by:

Degree of Combined Leverage (DCL) = DOL * DFL

- Solution

Cost of debt after tax (Kdt)

= Kd (1-t)

= 10(1-0.30)

=7%

Where,

Kd= Cost of debt before tax

t= tax rate

Cost of Preference Share (Kps) = 12%

Next,

Cost of common equity (Ke)

= (D1/ P0 ) + g

=(10/150) + 7%

= 13.66%

Where, D1 = Dividend expected

P0 = Current Market price of equity

g = growth rate

Computation of Weighted Average Cost of Capital

| Source | Amount | Proportion (p) | Cost (k) | P * K |

|---|---|---|---|---|

| Debenture | 4,00,000 | 0.36 | 7 | 2.52 |

| Preferred Stock | 6,00,000 | 0.54 | 12 | 6.48 |

| Common Stock | 1,00,000 | 0.09 | 13.66 | 1.22 |

| Total | 11,00,000 | 0.99 | 32.66 | 10.22 |

Hence, the weighted average cost of capital is 10.22 %.

- Solution

Given,

Loan = 5,00,000

Interest rate = 10%

Amortized time = 5 years

We know,

PVA = PMT * PVIFAi,n

or, 5,00,000 = PMT * PVIFA10,5

or, 5,00,000 = PMT * 3.7908

or, PMT = Rs. 131898.28

Loan Amortization Schedule

| Year | Beginning amount (1) | Payment or PMT (2) | Interest (@10%) | Repayment of principle (4)= 2-3 | Ending balance (5)= 1 -4 |

|---|---|---|---|---|---|

| 1 | 5,00,000 | 131898.28 | 50,000 | 81898.28 | 418101.72 |

| 2 | 418101.72 | 131898.28 | 41810.17 | 90088.10 | 328013.61 |

| 3 | 328013.61 | 131898.28 | 32801.36 | 99096.91 | 228916.99 |

| 4 | 228916.99 | 131898.28 | 22891.66 | 206025.02 | 22891.66 |

| 5 | 22891.66 | 131898.28 | 2289.16 | 20602.5 | 0 |

The rounding effect is Rs. 2289.1

NOTE FOR UNDERSTANDING ONLY : While we calculate this we don’t write some decimal points, so during calculation is slight difference in final answer, but we can write it as rounding effect and write 0 in last.

Tips: The final value as ending balance must be zero.

- Solution

Net Cash Outlay (NCO) = Rs 5,00,000

Time = 5 Year

Cost of capital = 10%

For Project A

a. Calculation of NPV (Even Cashflow)

| Year | Cashflow | PVIFA @ 10% | PV |

|---|---|---|---|

| 0 | (5,00,000) | 1 | (5,00,000) |

| 1-5 | 2,00,000 | 3.7908 | 758160 |

| NPV= 758160- 5,00,000 = 258160 |

Since, the NPV is positive, We would accept the project.

b. Calculation of IRR

Step 1: Fake Factor or PBP Factor = NCO / Annual CFAT

=5,00,000/ 2,00,000

= 2.5

Step 2: Referring to PVFA table, the factor 2.5 lies between 2.5320 and 2.4830 which corresponds rate 28% and 29% respectively.

Step 3: In even Cashflow,

IRR = LR + [(LR Factor – Calculated Factor / LR Factor – HR Factor)] * (HR – LR)

= 28 + [(2.5320 – 2.5/ 2.5320 – 2.4830 )]*( 29- 28)

= 28.65 %

Since, the IRR is positive, We would accept the project

For Project B

a. Calculation of NPV (Un-Even Cashflow)

| Year | Cashflow | PVIFA @ 10% | PV |

|---|---|---|---|

| 0 | (5,00,000) | 1 | (5,00,000) |

| 1 | 2,00,000 | 0.9091 | 181820 |

| 2 | 2,50,000 | 0.8264 | 206600 |

| 3 | 2,40,000 | 0.7513 | 180312 |

| 4 | 1,90,000 | 0.6830 | 129770 |

| 5 | 2,10,000 | 0.6209 | 130389 |

| NPV= 8,28,891- 5,00,000 = 328891 |

Since, the NPV is positive, We would accept the project

b. Calculation of IRR

Step 1:

Average CFAT = Sum of CFAT over year / Number of Year

= (2,00,000 + 2,50,000 +2,40,000 + 1,90,000 + 2,10,000 ) / 5

=10,90,000 / 5

= 2,18,000

Fake Factor or PBP Factor = NCO / Average CFAT

=5,00,000/ 2,18,000

= 2.29347

Step 2: Referring to PVFA table, the factor 2.29347 lies between 2.3021 and 2.2604 which corresponds rate 33 % and 34 % respectively.

| Year | CFAT (Rs) | PVIF @ 33 % | PV (Rs.) | PVIF @ 34% | PV (Rs) |

|---|---|---|---|---|---|

| 1 | 2,00,000 | 0.7519 | 1,50,380 | 0.7463 | 1,49,260 |

| 2 | 2,50,000 | 0.5653 | 1,41,325 | 0.5569 | 1,39,225 |

| 3 | 2,40,000 | 0.4251 | 1,02,024 | 0.4156 | 99,744 |

| 4 | 1,90,000 | 0.3196 | 60,724 | 0.3102 | 58,938 |

| 5 | 2,10,000 | 0.2403 | 50,463 | 0.2315 | 48,615 |

| TPV | 5,04,916 | 495782 |

Now,

IRR = LR + [(TPVLR – NCO)/ (TPVLR – TPVHR)]* (HR-LR)

=33 + [(5,04,916- 5,00,000)/ (5,04,916- 495782)]* (34-33)

= 33 + [4,916 / 9,134]* (34-1733

= 33 + 0.5382 * 1

=33.5382 %

Since, the IRR is positive, We would accept the project.

However when we compare these two project with each other, on the basis of both IRR and NPV, Project B has greater NPV value so we should choose that

Solution of Year 2022

- The objective of financial management are:

a. Wealth maximization for shareholders.

b. Profit maximization through efficient operations.

c. Risk management and mitigation.

d. Ensuring adequate liquidity. - The concept of “time value of money” is that the value of a unit of money is different in different time period.

- The optimal capital structure is the balance between debt and equity financing that minimizes the company’s cost of capital while maximizing shareholder value and financial flexibility.

Or,

The optimal capital structure of a company refers to the most effective balance between debt and equity funding, aiming to boost the firm’s market worth while reducing its overall cost of capital.

- Ordinary equity, or common equity, is the ownership in a company that regular shareholders have, giving them a claim on assets and a chance for dividends, but also carrying the highest risk.

Understand this word in brief:

Ordinary equity, also known as common equity, refers to the ownership interest in a company held by common shareholders. This type of equity represents the residual claim on a company’s assets after all other obligations, such as debt and preferred stock, have been satisfied. Common shareholders typically have voting rights and may receive dividends, although dividends are not guaranteed and are typically paid out after preferred shareholders have been compensated. Ordinary equity holders are considered the true owners of the company and bear the highest level of risk, but they also have the potential to benefit the most from the company’s success through capital appreciation and dividend payments. - Solution

Discount = 3 %

Discount period (DP) = 10

Credit period (CP) = 45

We know,

Annual Percentage Cost (APC) = [DR/ (100-DR)] * [t/ (CP -DP)]

or, APC= [3/ (100-3)] * [365/ (45 -10)]

or, APC = 0.30 * 10.428

or, APC = 0.322

or, APC = 32.25 %

Hence, the annual percentage cost is 32.25 %. - Solution

Present Value (PV) = ?

Future Value (FV) = Rs 2,00,000

Interest Rate (i) = 12%

Time (n) = 10 years

We know,

FV = PV (1 + i)n

or, 2,00,000 = PV (1 + 0.12)10

or 2,00,000 / 3.10= PV

or, PV= Rs. 64394.64

Hence, the present value is Rs 64394.64.

- ABC analysis system is a popular method or techniques of inventory management or optimization in supply chain.

The ABC analysis system categorizes items into three groups based on their significance:

A: High-value items with a small quantity but significant value.

B: Moderate-value items with a moderate quantity and value.

C: Low-value items with a large quantity but low value.

- This is Repeated question from 2023, question number 12 (please refer back to that year )

- The factors affecting capital structure of a decision of a firm are:

a. Size of the firm: There is positive relationship between the capital structure and size of the firm. The large firms are more diversified, have easy access to the capital market, receive higher credit ratings for debt issues, and pay at lower interest rate on debt capital. Therefore, larger firms intend to use more debt capital structure than smaller firms.

b. Growth and stability of sales: Firm whose sales are relatively stable can use more debt which earning per share of a firm us likely to be magnified by leverage. The firm is likely to be magnified. Rapidly growing firms tend to use more debt than slower growing firms.

c. Operating leverage : There is negative relationship between operating leverage and debt level in capital structure. The firm operating with high degree of operating leverage tends to use less amount to manage the total risk. The firm operating with low degree of operating leverage is likely to use more debt capital in capital structure.

d. Stability in cash flow: The firm’s cash flow stability also affects its capital structure. If the firms cash flow are relatively stable, then it may find no difficulties in meeting its fixed payment of interest and principal on time. As a result, the firm may attempt to take the benefits of leverage by using significant amount of debt.

e. Desire to control: If existing management wants to maintain the control power in the firm, it should go for debt financing because issues of new shares in the market may dilute the controlling power of existing shareholders.

f. Business risk: There is negative relation between the capital structure and business risk. The chance of business failure is greater if the firm has less stable earnings. As business risk increase, the debt level in capital structure of the company should decrease.

- Solution:

Annual Requirement (A) = 500,000 units

Ordering cost per order (O) = Rs 1000

Carrying cost per unit per year (C) = Rs 10

Lead time = 12 days

We know,

a. Economic Order Quantity i.e. EOQ = √(2AO / C)

= √ (2 * 500,000 * 1000) / 10

= 10,000units

b. Cost of Economic Order Quantity = √(2AOC)

= √(2 * 5,00,000 * 1000 * 10)

= Rs 100,000

C. Re-Order Level (ROL) = Daily consumption * Lead time

= (5,00,000 / 365) * 12

= 16438 units

Here,

Daily Consumption = Annual consumption or requirement / days in a year

= 5,00,000 / 365

=1369 units

- Cost of debt after tax (Kdt)

= Kd (1-t)

= 10(1-0.30)

=7%

Where,

Kd= Cost of debt before tax

t= tax rate

Cost of Preference Share (Kps) = 12%

Next,

Cost of common equity (Ke)

= (D1/ P0 ) + g

=(10/150) + 7%

= 13.66%

Where, D1 = Dividend expected

P0 = Current Market price of equity

g = growth rate

Computation of Weighted Average Cost of Capital

| Source | Proportion (p) | Cost (k) | P * K |

|---|---|---|---|

| Debt | 0.20 | 7 | 1.4 |

| Preference Share | 0.30 | 12 | 3.6 |

| Common Equity | 0.50 | 13.66 | 6.83 |

| Total | 1 | 13.66 | 11.83 |

Hence, weighted average cost of capital =11.83%

- Solution

Given

interest rate (i) = 10 %

Time (n) = 5 years

Present value (PV) = Rs 1,00,000

PVA = PMT * PVIFAi,n

or, 1,00,000 = PMT * PVIFA10,5

or, 1,00,000 = PMT * 3.7908

or, PMT = 26379.65

Loan Amortization Schedule

| Year | Beginning amount (1) | Payment or PMT (2) | Interest (@10%) | Repayment of principle (4)= 2-3 | Ending balance (5)= 1 -4 |

|---|---|---|---|---|---|

| 1 | 1,00,000 | 26379.65 | 10,000 | 16379.65 | 83620.35 |

| 2 | 83620.35 | 26379.65 | 8362.035 | 18017.615 | 65602.735 |

| 3 | 65602.735 | 26379.65 | 6560.273 | 19819.376 | 45783.359 |

| 4 | 45783.359 | 26379.65 | 4578.33 | 21801.314 | 23982.044 |

| 5 | 23982.044 | 26379.65 | 2398.204 | 23981.445 | 0 |

- Solution

a. Calculation of Net investment at the beginning

| Particulars | Amount |

|---|---|

| Cost of Plant | (1,00,000) |

| Installation Cost | (1,00,000) |

| Working Capital (increase) | (40,000) |

| NCO | (2,40,000) |

Hence, The calculation of Net investment at the beginning is Rs 2,40,000.

b. Calculation of Annual Cashflow after Tax

Calculation of Annual CFAT

| Particulars | Amount (Rs) |

|---|---|

| Sales | 5,00,000 |

| Less: Operating expense | (2,00,000) |

| Earning before Tax and Depreciation (EBDT) | 3,00,000 |

| Less: Depreciation | (28,000) |

| Earning before Tax (EBT) | 2,72,000 |

| Less: Tax @ 40% | (1,08,800) |

| Earning after Tax (EAT) | 1,63,200 |

| Add back: Depreciation | 28,000 |

| Annual CFAT | 1,91,200 |

Where,

Depreciation = ( Cost i.e. NCO – BSV ) / Life

= (2,40,000 – 1,00,000 )/ 5

= 1,40,000 / 5

= 28,000

Calculation of Final Year CFAT

| Particulars | Amount (Rs) |

|---|---|

| Annual CFAT | 1,91,200 |

| Less: Working Capital increased | (40,000) |

| Cash Salvage Value | 80,000 |

| Tax adjustments: | |

| CSV final year 80,000 | |

| Less: BSV at final Year (1,00,000) | |

| Therefore, Loss | (20,000) |

| Tax Saving @40% on 20,000 | 8,000 |

| Final Year CFAT | 2,39,200 |

c. Calculation of Net Present Value (NPV)

| Year | Cashflow | DF @ 10% | PV |

|---|---|---|---|

| 1-4 | 1,91,200 | 3.1699 | 606084.88 |

| 5 | 2,39,200 | 0.6209 | 148519.28 |

| TPV = 754604.16 Less: NCO =( 2,40,000) NPV= 514604.16 |

Hence, the Net Present Value (NPV) is Rs 514604.16.

Solution of Year 2023

- Repeated question

- An ordinary annuity refers to a series of equal payments made at regular intervals over a specified period of time. These payments are typically made at the end of each period, such as monthly, quarterly, or annually.

- Solution

Present Value (PV) = ?

Future Value (FV) = Rs 3,000

Interest Rate (i) = 12%

Time (n) = 10 years

We know,

FV = PV (1 + i)n

or, 3,000 = PV (1 + 0.12)10

or 3,000 / 3.10= PV

or, PV= 967.74

Hence, the present value is Rs 967.74

- Short term financing is required because:

a. Less costly: It is less costly as compare with long term financing. Some short term fund accruals and trade credit may be cost free.

b. Speed: It can be obtained much quickly than long term fund. Long term lending is more risky than short term lending to lenders. they will insist more through financial examination before extending long term credit. Long term fund need detail financial investigations.

c. Flexibility: There is sufficient flexibilities in short term fund to meet the seasonal, cyclical and working capital funds requirements and repay there is not need for such funds by avoiding long term commitments.

d. Less restriction: Short term fund credit agreements are less restrictive than that of long term fund credit agreement. Generally long term agreement contains provisions or covenants on taking additional loan, dividend distribution, etc., but some extend short term fund is not need those types of restrictions.

e. Collateral: Short term fund not need collateral and security, but long term loan requires specific assets as collateral. Generally current assets use to collateral for short term financing, however fixed assets are used as collateral for long term financing.

- Solution

Let us suppose,

Present Value (PV) = Rs 100

Future Value (FV) = Rs 200

Given,

Interest rate (i) = 15 %

Time (t) = ?

We know,

FV = PV (1 + i)n

or, 200 = 100 (1 + 0.15)n

or 2 = 1.12n

Taking log on both sides,

Log 2 / Log 1.15 = n

or, 0.30 / 0.06 = n

or, 4.95 = n

Hence, it will take 4 years to double the investment on 15 % interest rate.

- Solution:

Given,

Market price (P0) = Rs 300

Expected Dividend (D1) = Rs 30

Growth Rate (g) = 5 %

Flotation cost = 10% = (10 * 300) / 100 = Rs 30

We know,

Net Proceed (NP) = Rs 300 – 30

= Rs 270

Now,

Cost of Retained Earning (Ke)

= (D1/ P0 ) + g

=(30/300) + 5%

= 15 %

Cost of common equity (Ke)

= (D1/ NP ) + g

=(30/270) + 5%

= 16.11 %

Hence, cost of common equity and retained earning are 16.11 % and 15 % respectively.

- Solution

a. Solution

Time = 10 years

Interest = 18 %

Periodic Payment (PMT) = Rs 9,000

We know,

PVA = PMT * PVIFAi, n

= 9,000 * PVIFA18 %,10

= 9,000 * 4.4941

= Rs 40446.9

b. Solution

Payment (PMT) = Rs 9,500

Time = 5 years

Interest = 16 %

We know,

PVdue = PMT * PVIFAi, n

= 9,500 * PVIFA16, 5

= 9500 * 3.2743

= Rs 31105.85

- Solution

For Truck

a. Calculation of PBP

PBP = NCO / Annual Cashflow

= 17,000 / 10,000

= 1.70 Years

b. Calculation of NPV

| Year | Cashflow | PVIFA @ 14%, 3 YRS | PV |

|---|---|---|---|

| 0 | (17,000) | 1 | (17,000) |

| 1-3 | 10,000 | 3.7908 | 23,216 |

| NPV= 6,216 |

c. Calculation of IRR

Step 1: Fake Factor or PBP Factor = NCO / Annual CFAT

=17,000/ 10,000

= 1.70

Step 2: Referring to PVFA table, the factor 1.70 lies between 1.7188 and 1.6959 which corresponds rate 34% and 35% respectively.

Step 3: In even Cashflow,

IRR = LR + [(LR Factor – Calculated Factor / LR Factor – HR Factor)] * (HR – LR)

= 34+ [(1.7188 – 1.70 / 1.7188 – 1.6959 )]*( 35- 34)

= 34.82 %

For Pully

a. Calculation of PBP

PBP = NCO / Annual Cashflow

= 23,000 / 15,000

b. Calculation of NPV

| Year | Cashflow | PVIFA @ 14%, 3 Yrs | PV |

|---|---|---|---|

| 0 | (23,000) | 1 | (23,000) |

| 1-3 | 15,000 | 2.3216 | 34824 |

| NPV=11,824 |

c. Calculation of IRR

Step 1: Fake Factor or PBP Factor = NCO / Annual CFAT

=23,000/ 15,000

= 1.53

Step 2: Referring to PVFA table, the factor 1.53 lies between 1.5303 and 1.5116 which corresponds rate 43% and 44% respectively.

Step 3: In even Cashflow,

IRR = LR + [(LR Factor – Calculated Factor / LR Factor – HR Factor)] * (HR – LR)

= 43+ [(1.5303 – 1.53 / 1.5303 – 1.5116 )]*( 44- 43)

= 43.01%