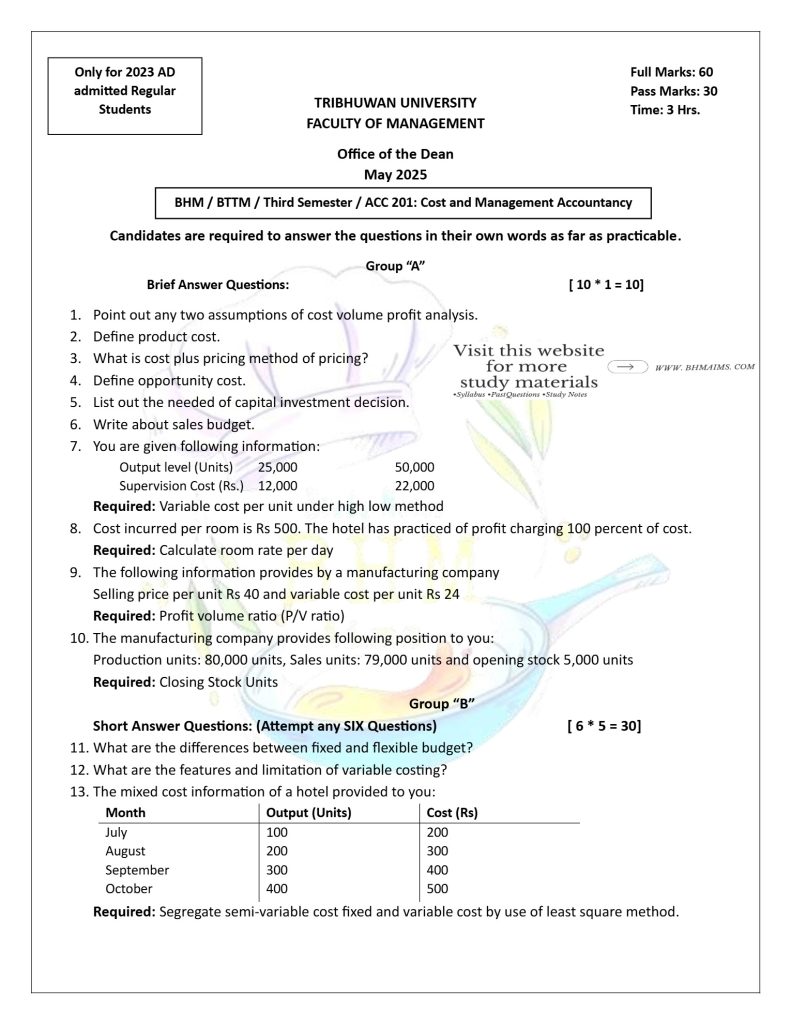

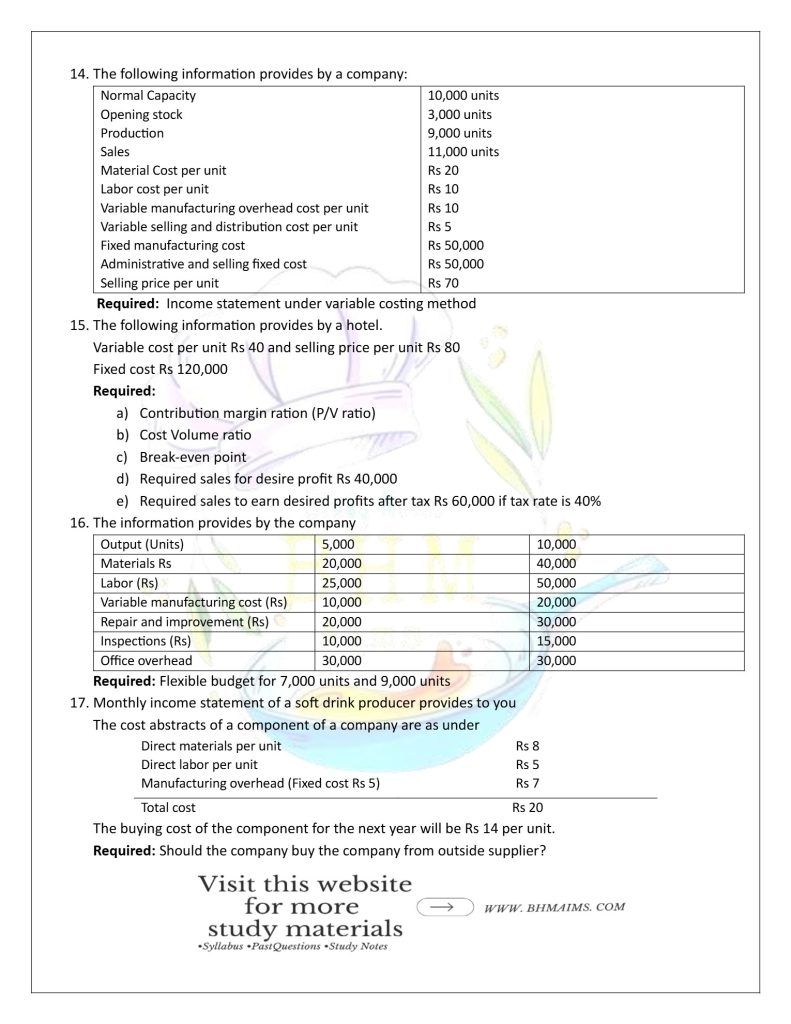

Cost and Management Accountancy Year 2025 Question Paper (New Course)

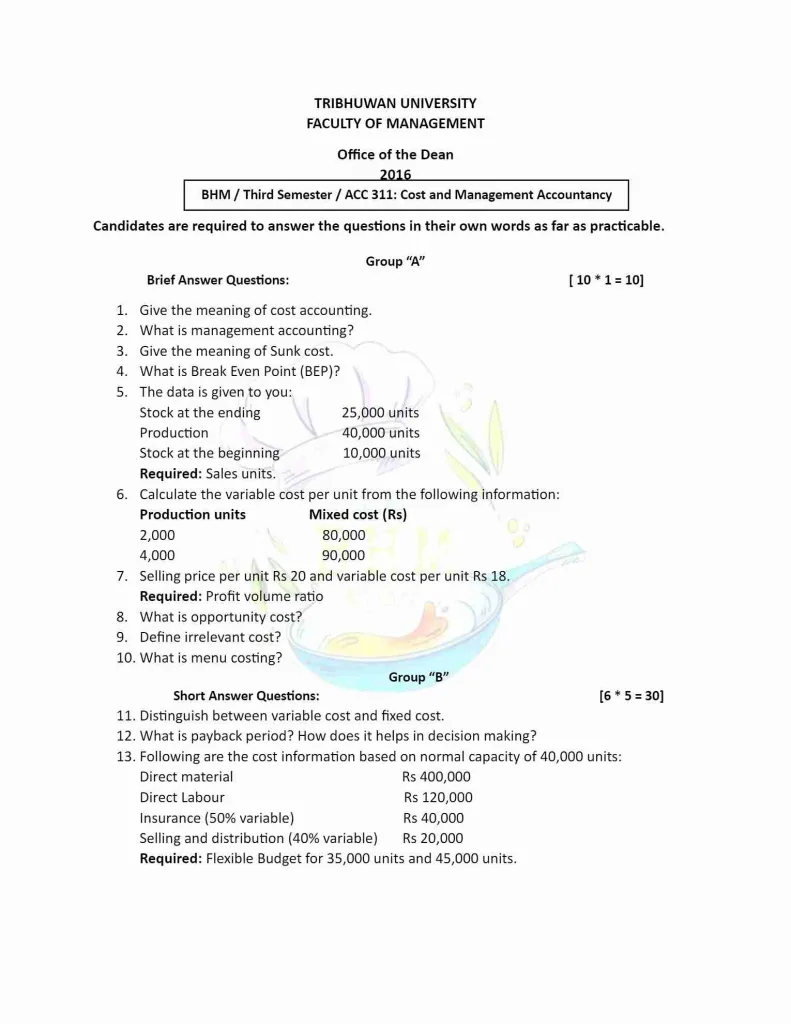

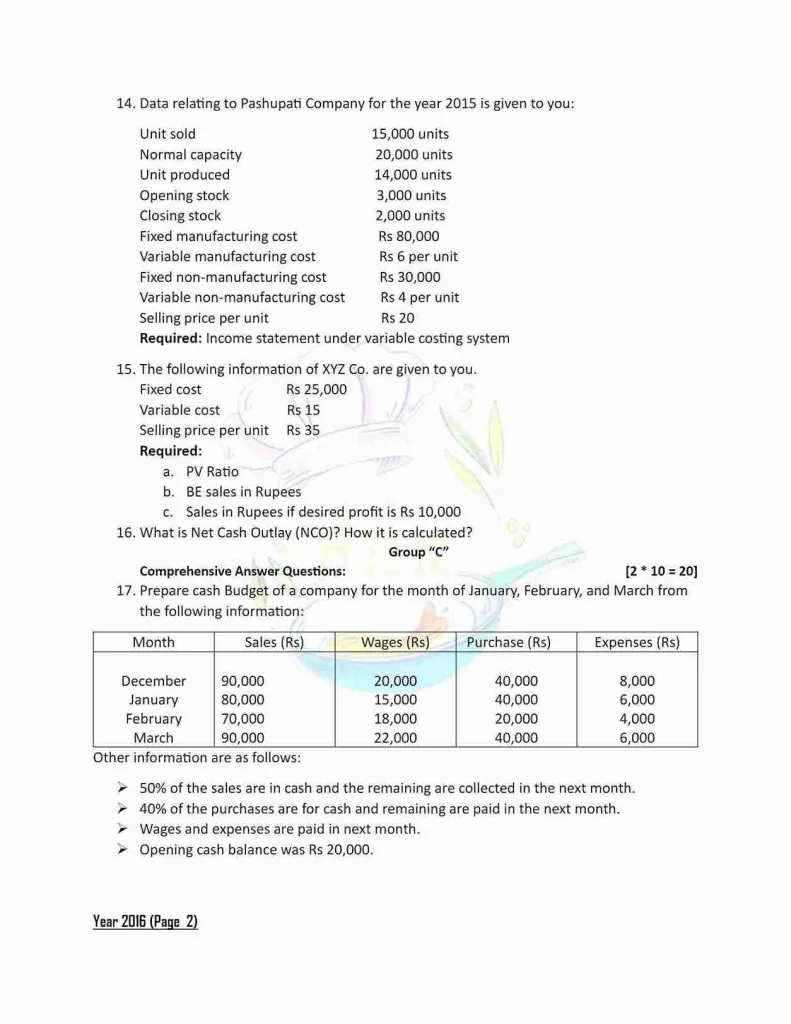

Cost and Management Accountancy Year 2016 Question Paper (Old Course)

Cost and Management Accountancy Year 2017 Question Paper (Old Course)

Qn 7: Required to find out Break-even points in units

QN 9 : Required to to find out production units

Cost and Management Accountancy Year 2018 Question Paper (Old Course)

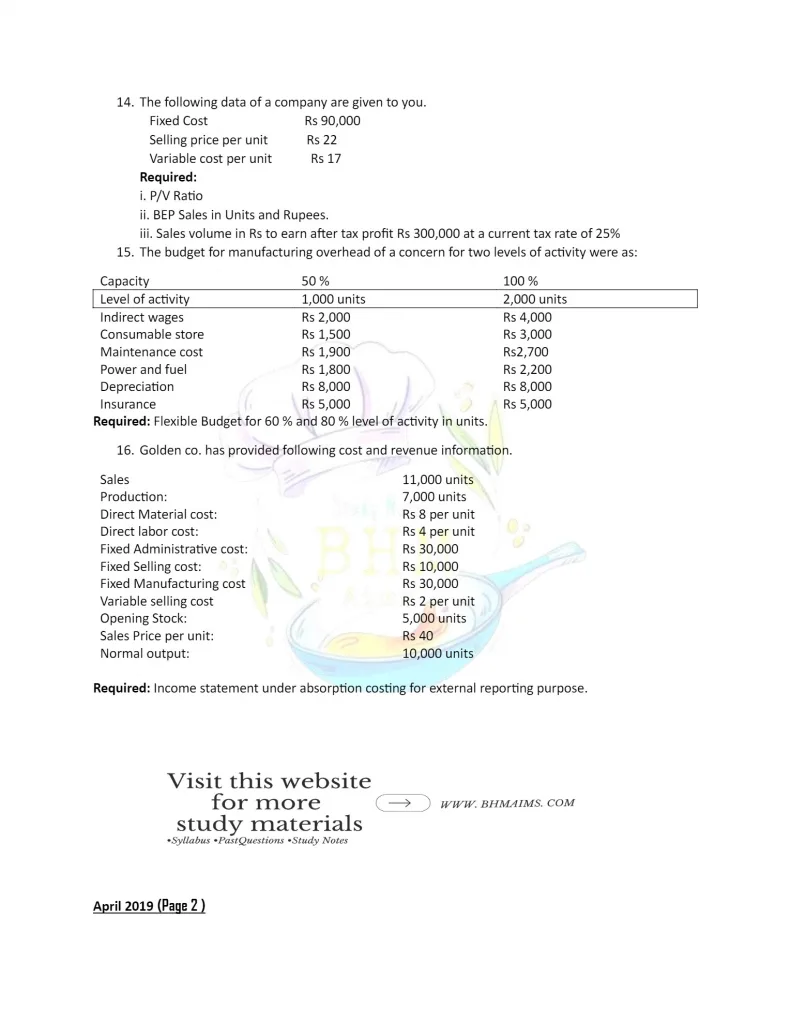

Cost and Management Accountancy Year 2019 Question Paper (Old Course)

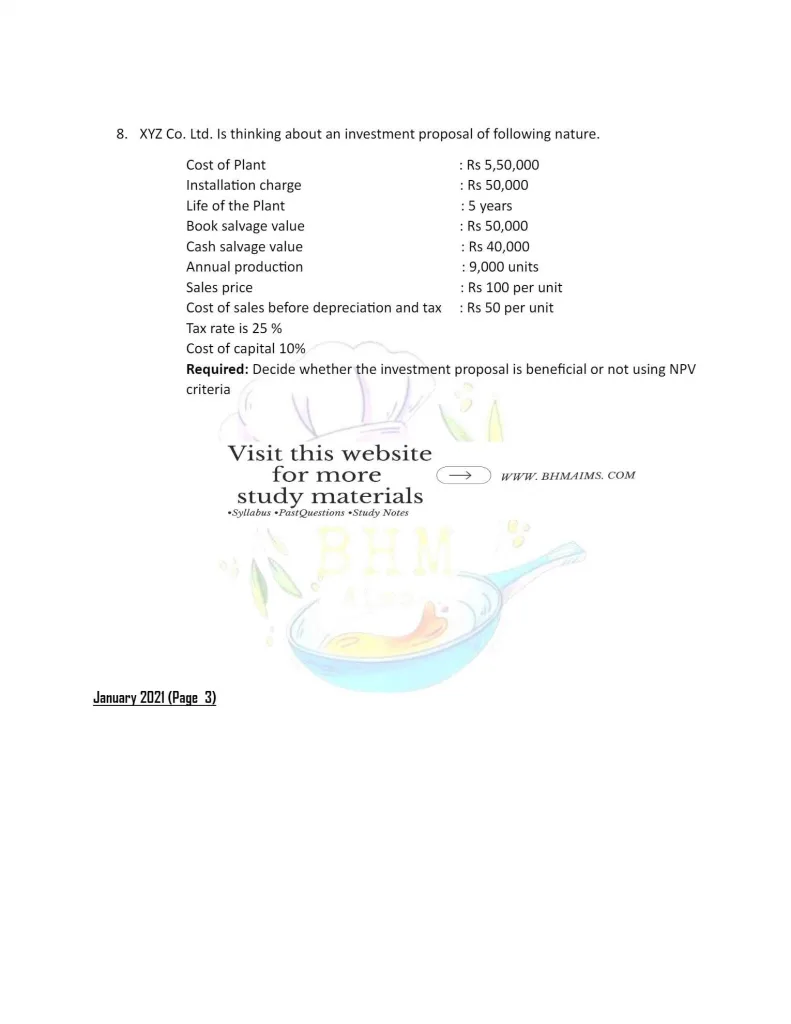

Cost and Management Accountancy Year 2021 Question Paper (Old Course)

Question Number 4: Required – VCPU and Fixed Cost by Least Square Method

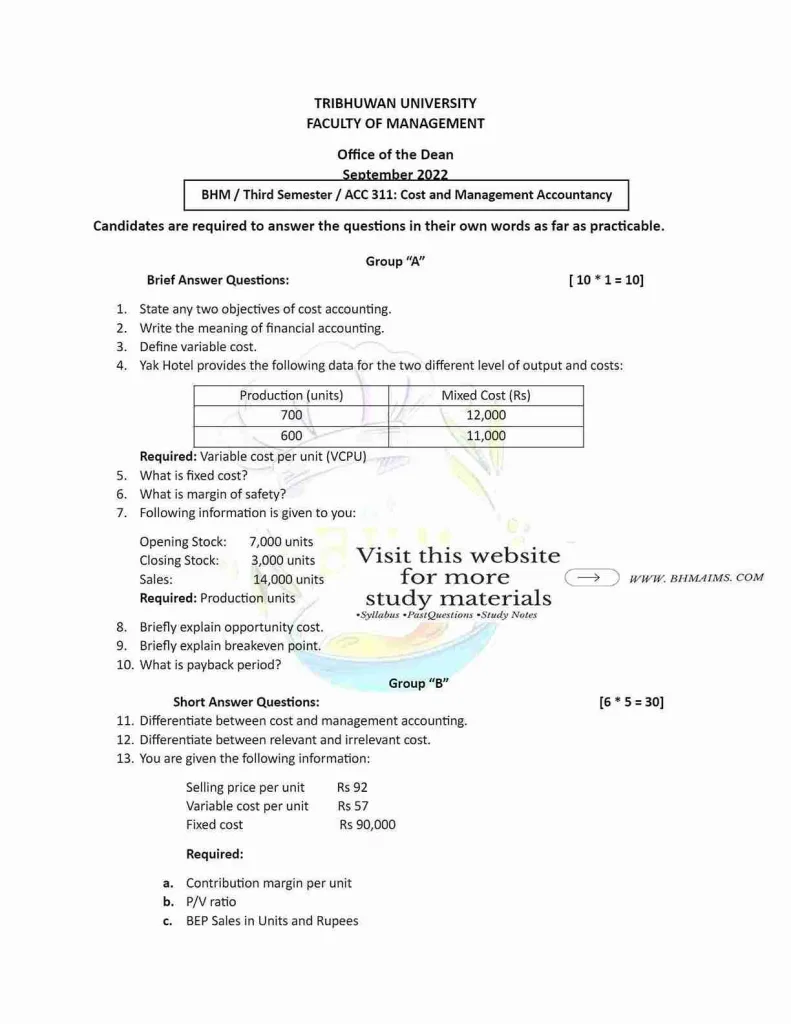

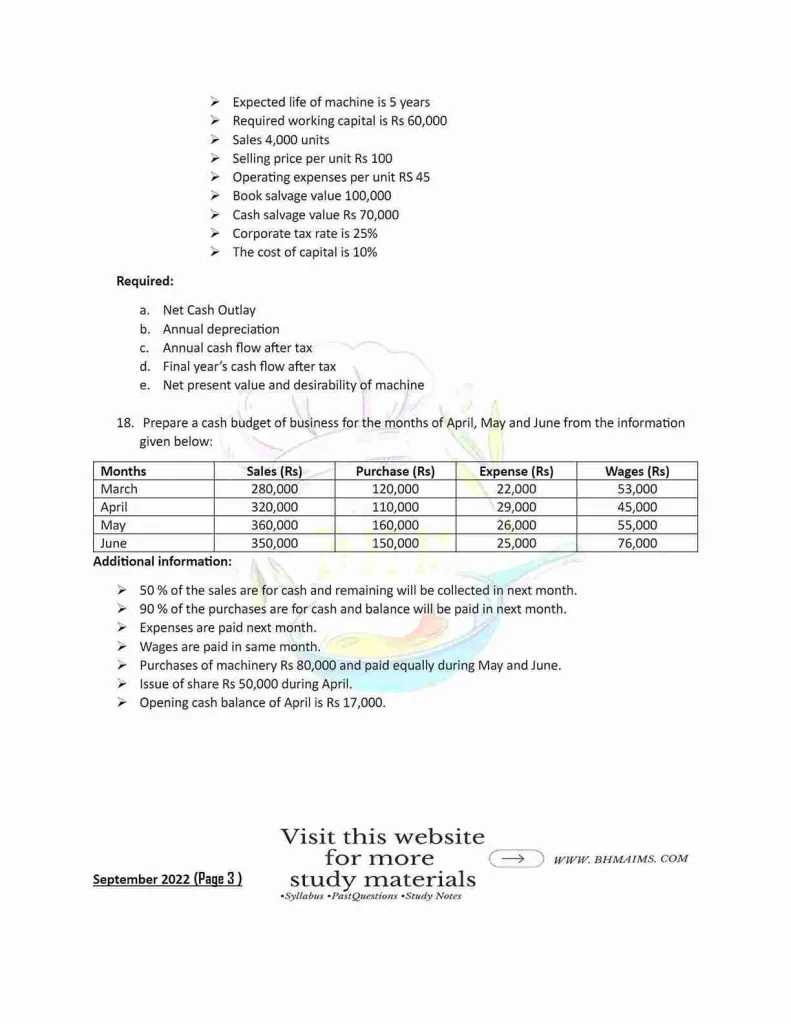

Cost and Management Accountancy Year 2022 Question Paper (Old Course)

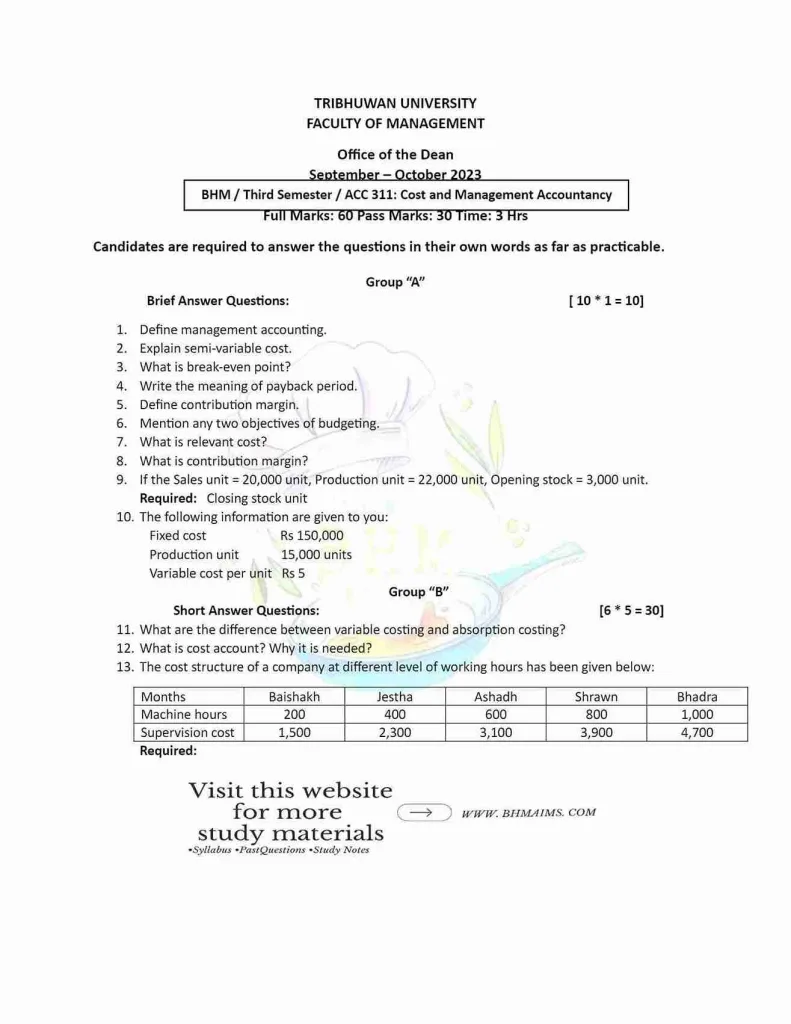

Cost and Management Accountancy Year 2023 Question Paper (Old Course)

QN 10 – Required to find out Total Cost

Solved Solution

Please review it for accuracy and let us know if you find any mistakes at bhmaims@gmail.com. Thank You for Choosing Us!

Solution of Year 2016

Group A

- Cost accounting can be defined as the branch of accounting that deals with the recording, classification, allocation and reporting of current and prospective cost of various products and business.

In simple way, Cost accounting is a branch of accounting or a method which is used by business organization to keep track of and report on the various expenses involved in making their products or running their operations. - Management accounting, also known as managerial accounting is the branch of accounting which is concerned with all those activities which are helpful for different decision making process by management team. It is only used by the internal team of the organization, and this is the only thing which makes it different from financial accounting.

Simply, it is a process of providing financial information and resources to the managers in decision making. - Sunk cost, also known as retrospective cost can be defined as any cost that has already been spend and can’t be recovered, regardless of any future decisions or actions. For example: money or cost spent in marketing, research and development, etc.

- Break Even Point (BEP) can be stated as the level or point of sales at which total revenue equals total costs / expenditure, resulting in neither profit nor loss.

Simply, it is a point where there is neither profit nor loss. For example: If you have invested Rs 1,000 in making your product, and if you generated sales of Rs 1,000 only, then your business is at BEP level meaning if you earned even a Re 1 more then you are profit and if you earned even a Re 1 less than your investment then you are at loss. - Solution:

Given,

Closing stock = 25,000 units

Production = 40,000 units

Opening stock = 10,000 units

Sales unit =?

We know,

Production unit = Sales + Closing stock – Opening stock

or, 40,000 = x + 25,000 – 10,000

or, x = 40,000 +10,000 – 25,000

or, x = 25,000

Hence, the sales unit is 25,000 units.

- Solution:

Given,

High Cost= Rs. 90,000

Low Cost= Rs 80,000

High Unit= Rs. 4,000

Low Unit= Rs. 2,000

Variable Cost Per Unit (b)

= (High cost – Low Cost) / (High Unit – Low Unit)

= Rs.(90,000 – 80,000) / (4,000 – 2,000)

= Rs. 5

Hence, the variable cost per unit (VCPU) is Rs 5. - Solution:

Given:

Selling price per unit (SPPU) = Rs 20

Variable cost per unit (VCPU) = Rs 18

Profit volume ratio =?

- Any benefit or opportunity which is sacrificed is known as opportunity cost.

For example: If organization has opportunity to invest in one project out of 2 project (Project A & Project B), and if the organization decided to invest in project B, the opportunity cost would be project as they will lose potential revenue and growth that could have been generated from investing in project A. - The type of cost which are not changed due to the decision of management are known as irrelevant cost.

Example of irrelevant cost are depreciation, rent, salary of manager, etc. - Menu costing can be defined as the process or method of determining the selling price and the cost of producing various menu items in a restaurant or food and beverage service establishment.

Group B

- The differences between fixed cost and variable cost are:

| Basis | Fixed Cost | Variable Cost |

|---|---|---|

| Definition | It can be defined as the cost which remains constant i.e. unchanged regardless of any volume produced. | It can be defined as the cost which changes according the change in volume or output. |

| Nature | Time related | Volume related |

| Incurred when | They are definite so they are incurred no matter there is production of any units or not. Means, production भए पनि नभए पनि हुन्छ | Variable cost are incurred only when certain amount of units are produced. Means, production भयो भनी variable cost हुन्छ नत्र हुदैन |

| Unit cost | Fixed cost changes in units i.e. if unit production increases, fixed cost decreases and vice versa. So fixed cost is inversely proportional to number of output produced. | Variable cost remains constant or same, as per unit. |

| Behavior | It remains same or constant for given time period. | It is not static. i.e. it changes with change in output level. |

| Example | Depreciation, rent, salary, insurance, tax, etc. | Wages, commission on sales, packing expenses, material consumed, etc. |

- Payback period can also be called as investment return period or payout or payoff period. It is the length of time required to get back the original invest amount from the given investment project.

Simply, it is the number of years required to recover the original cash outlay.

Payback period (PBP) helps in decision making as it has following advantages:

- It is easy and widely used.

- It focused the liquidity aspect of the project.

- With the help of the PBP business organization evaluates the project, selects the project with shortest PBP project which helps to minimize their risk.

Hence, by using PBP technique any organization can calculate the required time to recover their investment because of which organization can select the project with less payback period time which makes their investment safe and speedy both. Overall, it helps in budgeting, planning and investing process to the business organization.

- Solution

Pashupati Company

Income Statement under Variable Costing

For the year ended 2015

| Particulars | Amount |

|---|---|

| A. Sales Revenue (20,000 * 15,000) B. Less: Variable cost of goods Variable manufacturing cost (6 * 14,000) | 3,00,000 (84,000) |

| Add: Opening Stock (6 * 3,000 ) Variable cost of goods available for sale Less: Closing stock (6 * 2,000) Variable cost of goods sold Gross contribution Margin (A – B) Less: Variable manufacturing cost (4 * 15,000) Net contribution margin Less: Fixed manufacturing cost Fixed Non- manufacturing cost Net Income | 18,000 10,2000 (12,000) 90,000 2,10,000 (60,000) 1,50,000 (80,000) (30,000) 40,000 |

- Solution:

Given,

Fixed Cost (FC) = Rs 25,000

Variable Cost Per Unit (VCPU)= Rs 15

Selling Price Per Unit (SPPU) = 35

Here,

Contribution Margin Per Unit (CMPU) = SPPU – VCPU

= Rs 35 – 15

= Rs 20

We know,

(a) PV Ratio = CMPU / SPPU

= 20 / 35

= 0.57

(b) BEP in Sales (In Rs) = Total Fixed Cost / PV Ratio

= Rs 25,000 / 0.57

= Rs 43750

(c) Sales in Rs if desired profit is Rs 10,000

= ( Fixed Cost + Desired Profit )/ PV ratio

= (25,000 + 10,000) / 0.57

= 35,000 / 0.57

= Rs 61403.50 - Net investment Outlay (NCO), also known as Initial Cash Outlay or Net investment means beginning sum of amount required for acquisition of projects or fixed assets. It refers cost of fixed assets including freight, transportation, installation, erection charge, custom duty, additional working capital, etc at present time or zero years.

The NCO in replacement project case is different than new projects. The NCO can be calculated as follows:

| For New Project | Amount (Rs) |

|---|---|

| Purchase price of new assets Installation / Erection / Transportation Working capital increased / Decreased Investment tax credit | (xxx) (xxx) (xxx) or xxx xxx |

| NCO | (xxx) |

| For Replacement Project (Differential NCO) | Amount (Rs) |

|---|---|

| Purchase price of New assets Installation / Erection / Transportation Working capital increased / Decreased CSV of old assets today Tax adjustments : CSV of old assets today xxx Less: BSV of old assets today (xxx) Gain / Loss xxx or (xxx) Tax outstanding on Gain Tax saving on loss Investment tax credit | (xxx) (xxx) (xxx) or xxx xxx (xxx) xxx xxx |

| NCO | (xxx) |

where,

CSV = Cash Salvage value

BSV = Book Salvage Value

For example: A organization is planning to buy new plant for Rs 1,00,000 and required installation Rs 10,000. The new plant required Rs 10,000 for working capital. The organization is in 20 % tax bracket and enjoys 10 % investment tax credit.

Required: NCO

Solution

Calculation of NCO (New Plant)

| Particulars | Amount (Rs) |

|---|---|

| Purchase price of plant Installation Working capital increased Investment tax credit (10 % of 1,00,000) | (1,00,000) (10,000) (10,000) 10,000 |

| NCO | (1,10,000) |

Group C

Solution of Year 2017

Group A

- Any two objective of financial accounting are:

a. It helps to record financial transactions.

b. It helps in decision making process both internal and external stakeholders. - Variable cost can be defined as the cost which is changed according to the changed in output but proportionately or in the same ratio. In other words, variable cost is increased if output is increased or decreased if output is decreased but in same ratio or proportionately.

For example: All the direct expenses like direct materials, direct cost, direct labour, etc. are variable cost. - Repeated from Year 2016, Question Number 4 (Please refer back to that year)

- Repeated from Year 2016, Question Number 10 (Please refer back to that year)

- Mixed cost is also known as semi-variable cost or semi-fixed cost, which can be defined as the combination of fixed cost and variable cost.

For example: Water charge, electricity charge, telephone charge. - Repeated from Year 2016, Question Number 9 (Please refer back to that year)

- Repeated from Year 2016, Question Number 12 (Please refer back to that year)

- Solution:

Given,

Variable cost per unit = Rs 40

Fixed cost = Rs 3,00,000

Selling price per unit = Rs 60

We know,

BEP (in units) = Fixed cost / (SPPU – VCPU)

= 3,00,000 / (60-40)

= Rs. 15,000 - Solution:

Given,

Opening Stock = Rs 4,000 units

Sales = 60,000 units

Closing stock = 3,000 units

Production units = ?

We know,

Production unit = Sales + Closing stock – Opening stock

or, x = 60,000 + 3,000 – 4,000

or, x = 59,000 units

Hence, the production units are 59,000 units.

- Repeated from Year 2016, Question Number 8(Please refer back to that year)

Group B

- The difference between management accounting and cost accounting are:

| Basis | Cost Accounting | Management accounting |

|---|---|---|

| Meaning | It is process of recording, classifying, summarizing, analyzing and interpreting the cost information and preparing report to use in cost controlling purpose. | It is process of recording, classifying, summarizing, analyzing and interpreting the different financial and non-financial information and preparing report to help in decision making process. |

| Objective | To determine cost as well as cost controlling. | To provide various useful information to the management for decision making purpose. |

| Scope | It is narrow concept than management accounting. | It is comparatively broad concept than cost accounting. |

| Deals with | It deals with (financial) i.e. quantitative transactions only. | It deals with both qualitative and quantitative aspects. |

| Nature | It mostly considers historical information. | It considers futuristic information. |

| Finite Principle | It follows a finite principle and procedure for the determination of cost. | It does not follow any finite principles and procedure all the times. |

| Dependency | It is generally considered independent. | It is generally considered dependent. |

- The objectives of the planning and budgeting can be listed as:

- To allocate available resources to achieve business objective effectively and efficiently.

- To determine standard for a specific period of time of each department of the business.

- To coordinate the various departmental activities (i.e. production, purchase, finance, sales, etc.)

- To combine the idea of all level of management in the preparing of the business plans .

- To determine the differences between budgeted and actual performance.

- To evaluate the performance of departmental manager

- Solution

| Production Units (X) | Cost (Y) | XY | X2 |

|---|---|---|---|

| 1 | 2 | 2 | 1 |

| 2 | 3 | 6 | 4 |

| 3 | 4 | 12 | 9 |

| 4 | 5 | 20 | 16 |

| ΣX= 10 | ΣY = 14 | ΣXY = 40 | ΣX2 = 30 |

Variable Cost Per Unit (b) = (NΣXY – ΣX * ΣY ) / [NΣX2 – (ΣX)2]

= (4 * 40 – 10 * 14)/ [4 * 30 – (10)2 ]

= Rs 1 per units

Total Fixed Cost (a) = (ΣY – b * ΣX) / N

= (14 – 1 * 10) / 4

= Rs 1

- Solution

Given,

Variable Cost Per Unit (VCPU) = Rs 30

Selling Price Per Unit (SPPU) = Rs 60

Fixed Cost (FC) = Rs 70,000

Here,

Contribution Margin Per Unit (CMPU) = SPPU – VCPU

= Rs 60 – 30

= Rs 30

We know,

(a) PV Ratio = CMPU / SPPU

= 30 / 60

= 0.5

(b) BEP in Sales (In Rs) = Total Fixed Cost / PV Ratio

= Rs 70,000 / 0.5

= Rs 1,40,000

(c) BEP in Sales (in Units)

= Total Fixed Cost / CMPU

= 70,000 / 30

= 2333.33 units

- Solution:

ABC Company

Income Statement under Absorption Costing

| Particulars | Amount (Rs) |

|---|---|

| A. Sales Revenue (70,000 * 10,000) B. Less: Cost of goods Direct Material Cost (14 * 8,000) Direct Labour Cost (8 * 8,000) Variable Manufacturing Overhead (5 * 8,000) Fixed Manufacturing Overhead (8 * 8,000) | 7,00,000 1,12,000 64,000 40,000 64,000 |

| Total Manufacturing Cost | 280,000 |

| Add: Opening Stock (35 * 5,000) Less: Closing Stock (35 * 3,000) | 175000 (1,05,000) |

| Cost of goods Sold before adjustment Add: Under Absorption of fixed manufacturing cost C. Cost of goods sold after adjustment Gross profit (A – C) Less: Non Manufacturing Cost / Operating Cost Fixed Selling Overhead | 3,50,000 16,000 3,36,000 3,34,000 (40,000) |

| Net income | 2,94,000 |

i. Closing Stock = Opening Stock + Production – Opening stock

= 5,000 + 8,000 – 10,000

= 3,000

ii. Fixed manufacturing Overhead Rate

= Fixed mfg overhead / Normal Capacity

= 80,000 / 10,000

= 8

- Solution:

Flexible Budget

| Level of Activity | Output 30,000 units | Output 70,000 units |

|---|---|---|

| A. Variable Cost: Direct material @ Rs 3 Direct Wages @ Rs 4 Direct expenses @ Re 1 Repair and maintenance cost @ Rs 0.2 Inspection Cost @ Rs 0.3 | 90,000 1,20,000 30,000 6,000 9,000 | 210,000 2,80,000 70,000 14,000 21,000 |

| Total variable Cost | 2,55,000 | 5,95,000 |

| B. Fixed Cost Depreciation Insurance Salaries Repair and maintenance cost Inspection Cost | 9,000 22,000 15,000 10,000 18,000 | 9,000 22,000 15,000 10,000 18,000 |

| Total Fixed Cost | 74,000 | 74,000 |

| Total Cost (A + B) | 2,55,000 + 74,000 = 3,29,000 | 5,95,000 + 74,000 = 669,000 |

Working Note: Segregation of Semi- variable Cost

a. Segregation of Repair and maintenance cost

Variable Cost Per Unit (VCPU)

= (High cost – Low Cost) /(High units – Low units)

= (22,000 – 18,000) / (60,000 – 40,000)

= 4,000 / 20,000

= Rs 0.2 per unit

Fixed cost = Low cost – VCPU * Low units

= 18,000 – 0.2 * 40,000

=Rs 10,000

b. Segregation of Inspection cost

Variable Cost Per Unit (VCPU)

= (High cost – Low Cost) /(High units – Low units)

= (36,000 – 30,000) / (60,000 – 40,000)

= 6,000 / 20,000

= Rs 0.3 per unit

Fixed cost = Low cost – VCPU * Low units

= 30,000- 0.3 * 40,000

=Rs 18,000

Group C

- Solution:

Cost of project / new machinery = Rs 14,00,000

Additional Installation Cost = Rs 1,00,000

Working Capital Requirement = 1,50,000

Calculation of NCO

| Particulars | Amount (Rs) |

|---|---|

| Project Cost Installation Cost Working Capital Required | 14,00,000 1,00,000 1,50,000 |

| NCO | 16,50,000 |

Calculation of CFAT

| Particulars | Amount (Rs) |

|---|---|

| Sales (105 * 25,000) Less: Operating Cost (65 * 25,000) EBDT Less: Depreciation Earning Before Tax (EBT) Less: Tax (30 % of 7,12,000) Earning after tax i.e. EAT Add back: Depreciation | 2625,000 (16,25,000) 10,00,000 (2,88,000) 7,12,000 (213600) 4,98,400 2,88,000 |

| Annual CFAT | 7,86,400 |

Calculation of Final Year CFAT

| Particulars | Amount (Rs) |

|---|---|

| Annual CFAT Add: C.S.V Tax saved (30 % of 30,000) Add: Working Capital | 7,86,400 30,000 9,000 1,50,000 |

| Final Year (CFAT) | 9,75,400 |

Calculation of NPV

| Year | Amount (Rs) | DF @11% | PV |

|---|---|---|---|

| 1 – 4 | 786400 | 3.1024 | 2439727.36 |

| 5 | 975400 | 0.5935 | 578899.9 |

| TPV = 3018627.26 NCO = (1650000) NPV = 1368627.26 |

NPV = Net Present Value

Hence the NPV is Rs 1368627.26.

Working NOTE:

1. Calculation of Depreciation

NCO (For calculating Depreciation) = Cost of Project + Additional Installation Cost

= 14,00,000 + 1,00,000

= Rs 15,00,000

Depreciation =( Cost – B.SV / Life)

= (15,00,000 – 60,000) / 5

= Rs. 2,88,000

| NOTE: If question had asked you would you select this project or not, then you can say ” In this case, we would accept the project since the NPV value is positive.” |

Solution of Year 2018

Group A

- Any two objectives of cost accounting are:

a. To determine the cost

b. To fix or determine the selling price

c. To analyze the cost

d. To control the cost - The cost which is constant or unchanged in different output or production is known as fixed cost. For example: Depreciation, salary, etc.

- Repeated from Year 2016, Question Number 4 (Please refer back to that year)

- Any two methods of pricing are:

a. Cost Plus Pricing Method

b. Gross Profit or Gross Margin Method (Cost of goods sold at base Method) - An example of high low method is:

Given,

High Cost= Rs. 40,000

Low Cost= Rs 20,000

High Unit= Rs. 3,000

Low Unit= Rs. 1,000

Variable Cost Per Unit (b)

= (High cost – Low Cost) / (High Unit – Low Unit)

= Rs.(40,000 – 20,000) / (3,000 – 1,000)

= Rs. 10

Fixed Cost (a)

= Highest Cost – High Units * b

=Rs. 40,000 – 15,000 * 2.5

=Rs. 2,500

- Solution:

Given,

Variable cost per unit (VCPU) = Rs 20

Fixed cost = Rs 4,00,000

Selling Price Per Unit (SPPU) = Rs 30

We know,

BEP (in units) = FC / (SPPU – VCPU)

= 4,00,000 / (30 – 20)

= 40,000 units

Hence, the breakeven point in units is 40,000 units. - Solution:

Closing stock = 5,000 units

Production = 30,000 units

Sales = 32,000 units

Opening Stock = ?

We know,

Production unit = Sales + Closing stock – Opening stock

or, 30,000 = 32,000 + 5,000 – x

or x = 32,000 + 5,000 – 30,000

or, x = 7,000 units

Hence, the opening stock is 7,000 units.

- Repeated from Year 2016, Question Number 10(Please refer back to that year)

- Repeated from Year 2016, Question Number 9 (Please refer back to that year)

- Repeated from Year 2016, Question Number 12 (Please refer back to that year)

Group B

- Capital budgeting is related to the decision making processes regarding the purchase of fixed assets or the investment into the various investment proposals or projects.

Hence, a capital investment decision refers to the process of evaluating and selecting long-term investments in assets or projects that are expected to generate higher returns over an extended period.

Capital budgeting is a long term investment decision process. So, here below are the types of investment projects or proposals:

- Mutually exclusive project

- Mutually related (independent) project

- New project

- Replacement project

- Expansion project

- Diversification project

- Research and Development

There are various methods or techniques of evaluation of investment proposals or project. Some of them are listed below:

A. Traditional Methods:

- Payback Period (PBP)

- Accounting or Average Rate of Return (ARR)

B. Discounted Cash Flow Methods:

- Net Present Value (NPV)

- Profitability Index (PI)

- Internal Rate of Return (IRR)

- The difference between management accounting and financial accounting are:

| Basis | Financial Accounting | Management Accounting |

|---|---|---|

| Focus | External | Internal |

| Users | External stakeholders, investors, lenders, government, suppliers | Internal management, decision-makers |

| Governed by | It is basically governed by the company Act of the concerned nation as well. | It is not governed by such act. Instead, it is installed with the need of management. |

| Purpose | Provides financial information to external parties | Helps in decision-making, planning, control |

| Time period | Long term | Short term |

| Frequency of report | Regular, usually quarterly and annually | Flexible, as needed |

| Focuses on | Focuses on historical financial performance | Focuses on future-oriented information |

| Scope | Limited to financial transactions | Broader, includes non-financial measures |

- Solution

Taking 1,000 as common (Note: You can continue without taking also. We did it just to reduce to length of number; however the final answer will be same. Its like dividing 1000 by 100 or 100 by 10 both will get same result.)

| Production Units (X) | Cost (Y) | XY | X2 |

|---|---|---|---|

| 1 | 3 | 3 | 1 |

| 2 | 4 | 8 | 4 |

| 3 | 5 | 15 | 9 |

| 4 | 6 | 24 | 16 |

| ΣX= 10 | ΣY = 18 | ΣXY = 50 | ΣX2 = 30 |

Variable Cost Per Unit (b) = (NΣXY – ΣX * ΣY ) / [NΣX2 – (ΣX)2]

= (4 * 50 – 10 * 18)/ [4 * 30 – (10)2 ]

= Rs 1 per units

Total Fixed Cost (a) = (ΣY – b * ΣX) / N

= (18 – 1 * 10) / 4

= Rs 2

- Solution

Given,

Variable Cost Per Unit (VCPU) = Rs 20

Selling Price Per Unit (SPPU) = Rs 50

Fixed Cost = Rs 60,000

Here,

Contribution Margin Per Unit (CMPU) = SPPU – VCPU

= Rs 50 – 20

= Rs 30

We know,

(a) PV Ratio = CMPU / SPPU

= 30 / 50

= 0.6

(b) BEP in Sales (In Rs) = Total Fixed Cost / PV Ratio

= Rs 60,000 / 0.6

= Rs 1,00,000

(c) BEP in Sales (In Rs) = Total Fixed Cost / CMPU

= Rs 60,000 / 30

= Rs 20,000 units - Solution

Closing Stock = Opening Stock + Production – Sales

= 3,000 + 8,000 – 10,000

= 1,000 units

Fixed Manufacturing Overhead Rate

= Fixed Manufacturing Overhead / Normal Capacity

= 80,000 / 8,000

= Rs 10

XYZ Company

Income Statement under Absorption Costing

| Particulars | Amount (Rs) |

|---|---|

| A. Sales Revenue (60,000 * 10,000) B. Less: Cost of goods Direct Material Cost (12 * 8,000) Direct labour Cost (10 * 8,000) Variable Manufacturing Overhead (5 * 8,000) Fixed Manufacturing Overhead (10 * 8,000) | 6,00,000 96,000 80,000 40,000 80,000 |

| Total Manufacturing Cost | 2,96,000 |

| Add: Opening Stock (37 * 3,000) Less: Closing Stock (37 * 1,000) Cost of goods Sold before adjustment Less: Fixed Selling Overhead | 111,000 (37,000) 3,70,000 40,000 |

| Net income | 3,30,000 |

Group C

- Solution:

Here,

Cost of Machine = Rs 22,00,000

Additional Installation cost = Rs 3,00,000

Working Capital = Rs 1,00,000

Life = 5 Years

BSV = Rs 80,000

CSV = Rs 40,000

We know,

Cost = Cost of a machine + Additional installation cost

= 22,00,000 + 3,00,000

= Rs 25,00,000

NCO = Cost + Working Capital

= 25,00,000 + 1,00,000

= Rs 26,00,000

Depreciation = (Cost – BSV) / Life

= (25,00,000 – 80,000) / 5

= Rs 4,84,000

Calculation of Annual CFAT

| Particulars | Amount (Rs) |

|---|---|

| Sales (100 * 30,000) Less: Operating Cost (40 * 30,000) Earning Before Depreciation and Tax (EBDT) Less: Depreciation Earning Before Tax (EBT) Less: Tax (25 % of 1,31,600) Earning After Tax (EAT) Add back : Depreciation | 30,00,000 (12,00,000) 18,00,000 (4,84,000) 1,31,600 (3,29,000) 9,87,000 4,84,000 |

| Annual CFAT | 14,71,000 |

Calculation of Final Year CFAT

| Particulars | Amount (Rs) |

|---|---|

| Annual CFAT Tax Saved Add: (25 % of 40,000) Add: CSV Add: Working Capital | 14,71,000 10,000 40,000 1,00,000 |

| Final Year CFAT | 16,21,000 |

Calculation of NPV

| Year | Amount (Rs) | PV factor @ 10 % | PV |

|---|---|---|---|

| 1-4 | 14,71,000 | 3.1699 | 4662922.9 |

| 5 | 1621,000 | 0.6209 | 100648.9 |

| TPV = 5669401.8 Less : NCO = (26,00,000) NPV =30,69,401.8 |

Solution of Year 2019

Group A

- Repeated from Year 2016, Question Number 1(Please refer back to that year)

- Financial accounting is a process of recording, classifying, summarizing, analyzing, and interpreting the different financial information in such a way that the true and fair position of the business as well as the net profit earned or loss incurred during certain time period can be known very easily through reports.

- Repeated from Year 2016, Question Number 3 (Please refer back to that year) NOTE: Semi variable and mixed cost are same.

- Solution:

Given,

High cost = Rs 1,400

Low cost = Rs 800

High output = 410

Low Output = 350

Variable cost Per Unit (VCPU) = ?

We know,

Variable Cost Per Unit (b)

= (High cost – Low Cost) / (High Unit – Low Unit)

= Rs.(1,400 – 800) / (410 – 350)

= Rs. 10

- Repeated from Year 2017, Question Number 2 (Please refer back to that year)

- Make or Buy decision is the decision regarding whether to produce the goods or provide the services within the organization or to obtain them from the outside suppliers.

- Solution:

Given,

Variable Cost Per Unit (VCPU) = Rs 85

Selling Price Per Unit (SPPU) = 102

Contribution Margin (CM) = ?

We know,

Contribution Margin = SPPU + VCPU

= Rs 85 + 102

= Rs 187

- The types of cost which are changed due to the decision of management are called relevant cost. For example: If management takes decision of increasing the production of output then costs of materials, labour also increases or changes.

- Repeated from Year 2016, Question Number 4(Please refer back to that year)

- Repeated from Year 2016, Question Number 10 (Please refer back to that year)

Group B

- The difference between controllable and uncontrollable cost are:

| Basis | Controllable Cost | Uncontrollable Cost |

|---|---|---|

| Meaning | Cost which can be controlled by the management are controllable cost. | Cost which cannot be controlled by the management are uncontrollable cost. |

| Includes | Generally variable costs are controllable cost. | Generally fixed costs are controllable cost. |

| Variability | May vary based on managerial decisions | Remains constant regardless of management actions |

| Examples | Labor costs, materials, utilities | Rent, property taxes, insurance premiums |

| Influence on Profitability | Directly affects profitability | Does not directly affect profitability |

- Repeated from Year 2017, Question Number 11 (Please refer back to that year)

- Solution

| Production Units (X) | Cost (Y) | XY | X2 |

|---|---|---|---|

| 110 | 225 | 24,750 | 12,100 |

| 100 | 210 | 21,000 | 10,000 |

| 140 | 290 | 40,600 | 19,600 |

| 130 | 255 | 33,150 | 16,900 |

| 120 | 235 | 28,200 | 14,400 |

| ΣX= 600 | ΣY = 1,215 | ΣXY = 1,47,700 | ΣX2 = 73,000 |

(a)

Variable Cost Per Unit (b) = (NΣXY – ΣX * ΣY ) / [NΣX2 – (ΣX)2]

= (5 * 1,47,700 – 600 * 1,215 )/ 5 * [73,000 -(600)2 ]

= Rs 2.025 per units

Total Fixed Cost (a) = (ΣY – b * ΣX) / N

= (1215 – 2.025 * 600) / 5

= Rs 0

- Solution:

Given,

Fixed cost = Rs 90,000

Selling Price Per Unit = Rs 22

Variable Cost Per Unit = Rs 17

Here,

Contribution Margin Per Unit (CMPU) =SPPU – VCPU

= Rs 22 – 17

= Rs 5

We know,

(i) PV Ratio = CMPU / SPPU

= 5 / 22

= Rs 0.227

(ii) BEP Sales

(In units)

= Total Fixed Cost / CMPU

= 90,000 / 5

= 18,000 units

(In Rs)

= Total Fixed Cost / PV ratio

= 90,000 / 0.227

= Rs 396475.77

(iii) Sales volume in Rs to earn profit Rs 30,000 at current tax rate of 25%

={Fixed Cost + [Desired Profit after tax / (1 – t)] } / PV Ratio

={90,000 + [3,00,000 / (1 – 0.25)] } / 0.227

={90,000 + [3,00,000 / 0.75] } / 0.227

={90,000 + 4,00,000 } / 0.227

=4,90,000 / 0.227

= Rs. 2158590.30

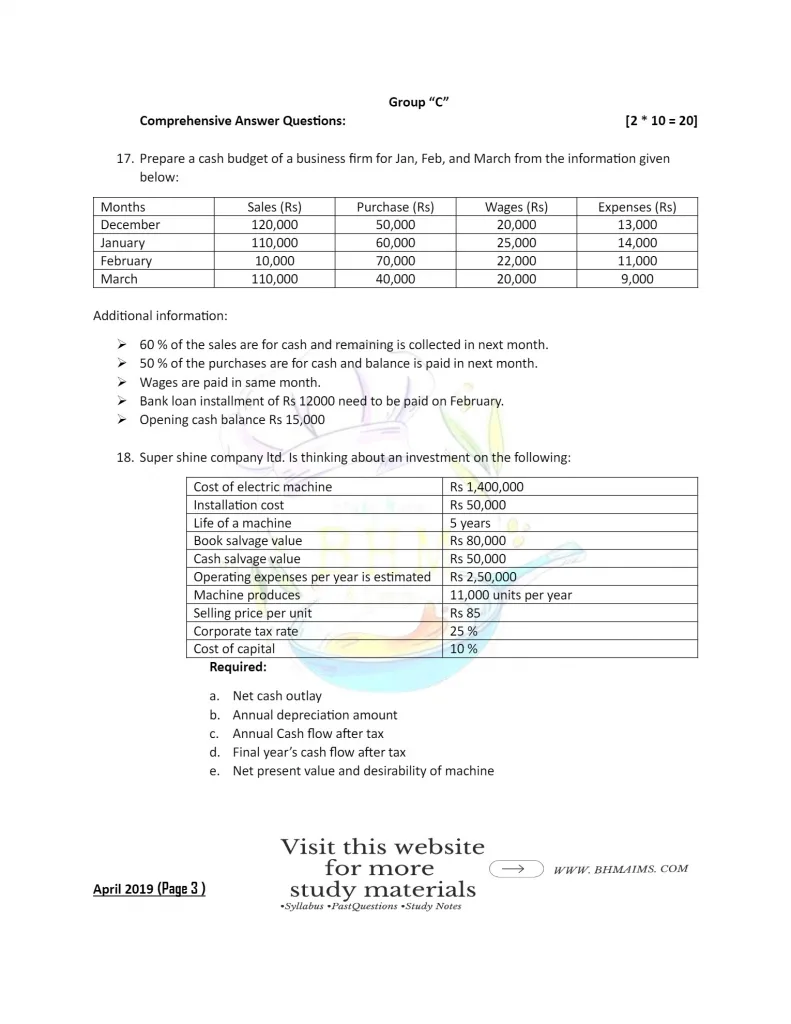

Group C

- Solution:

Here,

(a) Calculation of NCO

NCO = Cost of machine + Installation Cost

= 14,00,000 + 50,000

= 14,50,000

(b) Calculation of Depreciation

Depreciation = (Cost – BSV) / Life

= (14,50,000 – 80,000) / 5

= Rs 2,74,000

(c) Annual Cash Flow

| Particulars | Amount (Rs) |

|---|---|

| Sales (85 * 11,000) Less : Operating Expenses Earning before Depreciation and Tax (EBDT) Less: Depreciation Earning before Tax (EBT) Less: Tax (25 % of 4,11,000) Earning after tax (EAT) Add back : Depreciation | 9,35,000 (2,50,000) 6,85,000 (2,74,000) 4,11,000 (102750) 308250 2,74,000 |

| Annual CFAT | 5,82,250 |

Calculation of Final Year CFAT

| Particulars | Amount (Rs) |

|---|---|

| Annual CFAT Add: Tax (25 % of 30,000) Add: CSV | 5,82,250 7,500 50,000 |

| Final Year CFAT | 6,39,750 |

Calculation of NPV

| Year | Amount (Rs) | PV factor @ 10 % | PV |

|---|---|---|---|

| 1-4 | 5,82,250 | 3.1699 | 1845674.275 |

| 5 | 6,39,750 | 0.6209 | 397220.775 |

| TPV = 2242895.05 Less : NCO = (14,50,000) NPV =792895.05 |

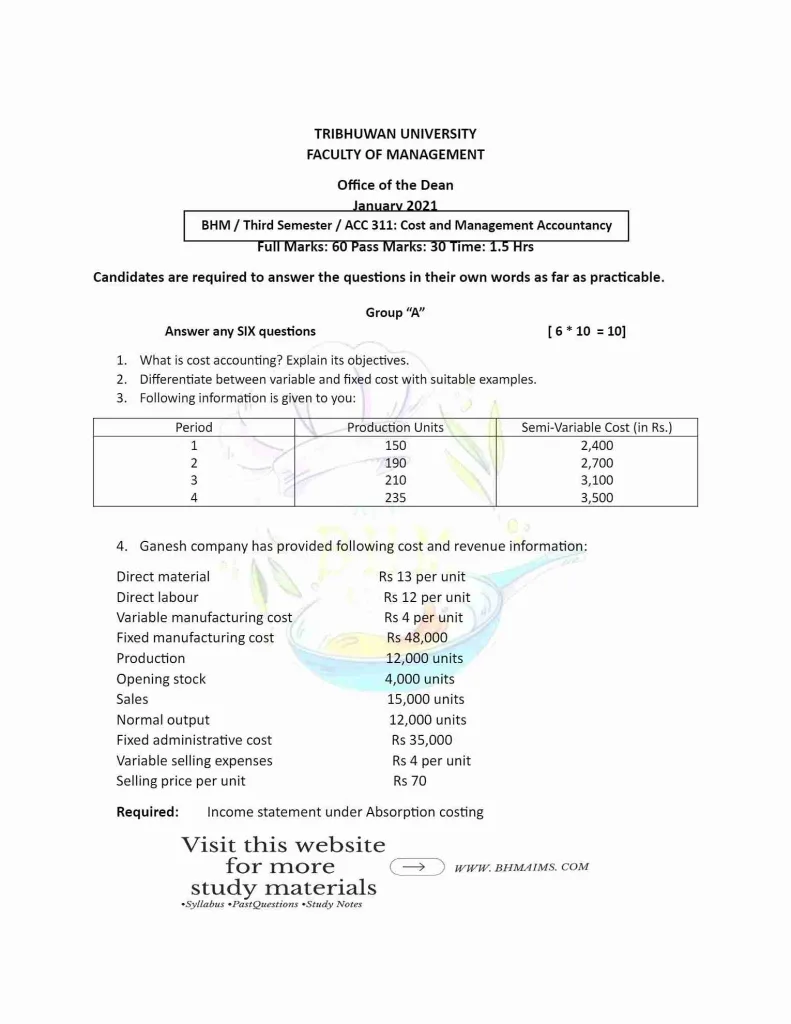

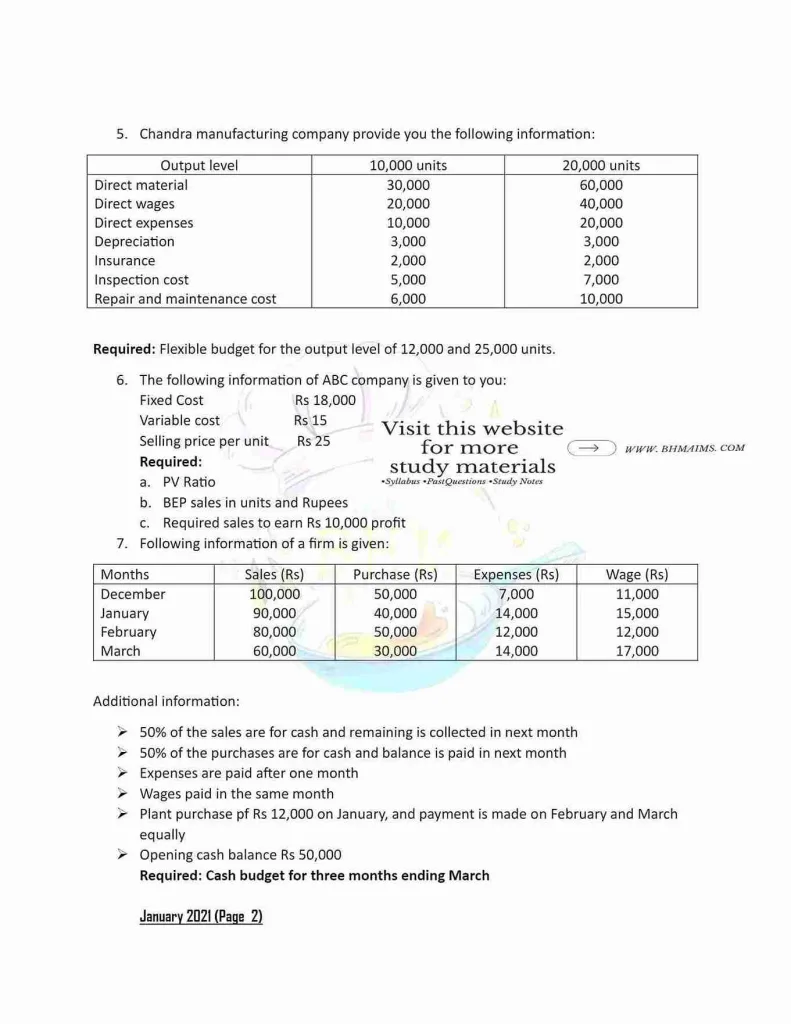

Solution of Year 2021

Group A

- Repeated from Year 2016 and 2018, Question Number 1(Please refer back to that year)

- Repeated from Year 2016, Question Number 11 (Please refer back to that year)

- Solution:

Given,

Fixed Cost (FC) = Rs 18,000

Variable Cost (VC) = Rs 15

Selling Price Per Unit (SPPU) = Rs 25

We know,

CMPU = SPPU – VCPU

= Rs 25 – 15

= Rs 10

Now,

(a) PV Ratio = CMPU / SPPU

= 10 / 25

= 0.4

(b) BEP in Sales

(In units)

= Total Fixed Cost / CMPU

= 18,000 / 10

= 1800 units

(In Rs)

= Total Fixed Cost / PV ratio

= 18,000 / 0.4

= Rs 45,000

(c) Sales to earn Rs 10,000 profit

=( Fixed Cost + Desired Profit) / PV ratio

= (18,000 + 10,000 )/ 0.4

= Rs 70,000

- Solution:

Net Cash Outlay (NCO) = Cost of plant + Installation charge

= Rs 5,50,000 + 50,000

= Rs 6,00,000

Depreciation = (Cost – BSV ) / Life

= (6,00,000 – 50,000)/ 5

= Rs 1,10,000

Calculation of Annual CFAT

| Particulars | Amount (Rs) |

|---|---|

| Sales (100 * 9,000) Less: Cost of Sales (50 * 9,000) Earning Before Depreciation and Tax (EBDT) Less: Depreciation Earning Before tax (EBT) Less: Tax (25 % of 34,00,000) Earning after Tax (EAT) Add back : Depreciation | 9,00,000 (4,50,000) 4,50,000 (110000) 340000 (85,000) 2,55,000 110000 |

| Annual CFAT | 3,65,000 |

Calculation of Final Year CFAT

| Particulars | Amount (Rs) |

|---|---|

| Annual CFAT Add: Tax (25 % of 10,000) Add: CSV | 3,65,000 2,500 40,000 |

| Final Year CFAT | 4,07,500 |

Calculation of NPV

| Year | Amount (Rs) | PV factor @ 10 % | PV |

|---|---|---|---|

| 1 to 4 | 3,65,000 | 3.1699 | 1157013.5 |

| 5 | 407500 | 0.6209 | 253016.75 |

| TPV = 1410030.25 NCO = 6,00,000 NPV = 810030.25 |

Solution of Year 2022

Group A

- Repeated from Year 2018, Question Number 1 (Please refer back to that year)

- Repeated from Year 2019, Question Number 2(Please refer back to that year)

- Repeated from Year 2017, Question Number 2 (Please refer back to that year)

- Solution:

Given,

High cost = Rs 12,000

Low cost = Rs 11,000

High output = 700

Low Output = 600

Variable cost Per Unit (VCPU) = ?

We know,

Variable Cost Per Unit (b)

= (High cost – Low Cost) / (High Unit – Low Unit)

= Rs.(12,000- 11,000) / (700 – 600)

= Rs. 10

- Repeated from Year 2018, Question Number 2 (Please refer back to that year)

- Margin of Safety (MOS) simply represent the range of sales where business organization is generally safe in regards of profit i.e. the additional amount of sales is capable to earn amount of profit.

Formula to calculate MOS can be listed as follow:

MOS = Actual or Budgeted Sales – Break Even Sales

or, MOS = Profit / PV Ratio

MOS Ratio= Margin of Safety in rupees / Total budgeted or actual sales - Solution:

Given,

Opening Stock = 7,000 units

Closing Stock = 3,000 units

Sales = 14,000 units

We know,

Production unit = Sales + Closing stock – Opening stock

= 14,000 + 3,000 – 7,000

= 10,000 units

Hence, the production units is 10,000 units.

- Repeated from Year 2016, Question Number 8 (Please refer back to that year)

- Repeated from Year 2016, Question Number 4 (Please refer back to that year)

- Repeated from Year 2016, Question Number 12 (Please refer back to that year)

Group B

- Repeated from Year 2017, Question Number 11 (Please refer back to that year)

- The differences between relevant cost and irrelevant cost are:

| Basis | Relevant Cost | Irrelevant Cost |

|---|---|---|

| Meaning | The type of costs which are changed due to the decision of management are called relevant cost. | The type of costs which are not changed due to the decision of management are called relevant cost. |

| Decision Impact | Influences the decision-making process | Does not influence the decision-making process |

| Future Relevance | Related to future events or decisions | Relates to past or sunk costs |

| Cost Reduction | Can potentially be reduced or eliminated to improve decision outcomes | Cannot be reduced or eliminated to affect decision outcomes |

| Nature | It is variable in nature. | It is fixed in nature. |

| Examples | Cost of materials, labour, etc. | Depreciation, Rent, Salary of manager, etc |

- Solution:

Given,

Selling Price Per Unit (SPPU) = Rs 92

Variable Cost Per Unit (VCPU) = Rs 57

Fixed Cost (FC)= Rs 90,000

We know,

i. CMPU = SPPU -VCPU

= Rs 92 – 57

= Rs 35

ii. P/V Ratio = CMPU / SPPU

= 35 / 92

= 0.3804

iii. BEP in Sales

(In Units)

= Total Fixed Cost / CMPU

= 90,000 / 35

= 2571.42 units

(In Rs)

= Total Fixed Cost / PV Ratio

= 90,000 / 0.3804

= Rs. 236593.05

Group C

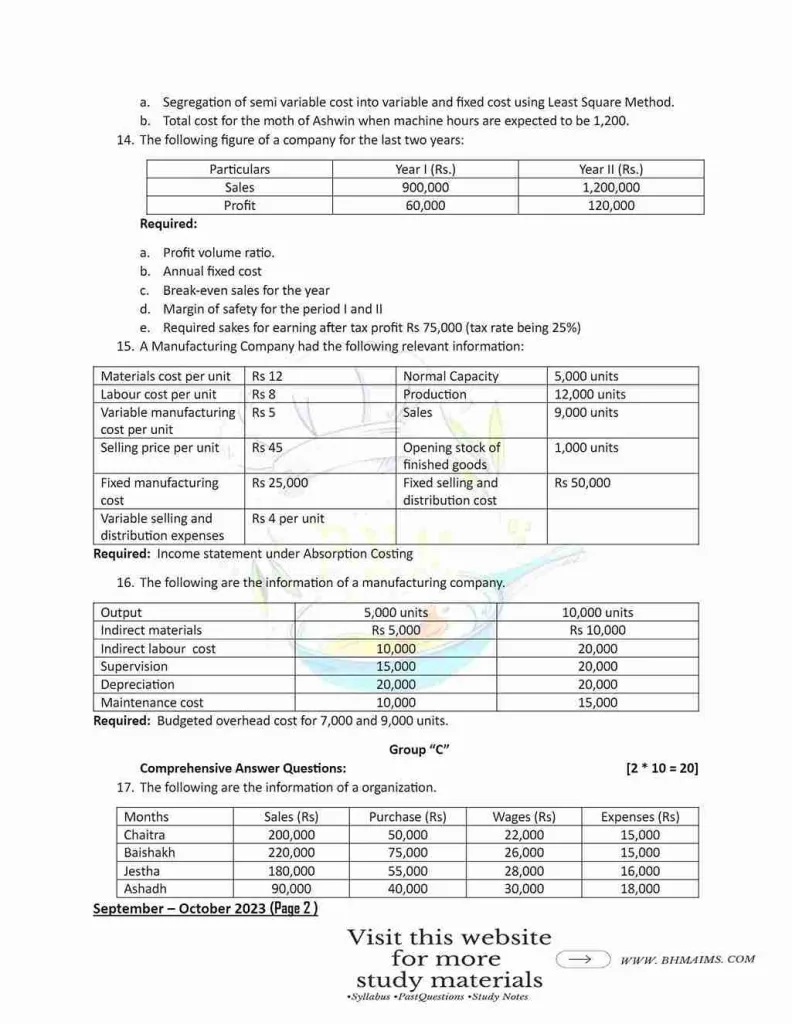

Solution of Year 2023

Group A

- Repeated from Year 2016, Question Number 2 (Please refer back to that year)

- Repeated from Year 2017, Question Number 5 (Please refer back to that year)

- Repeated from Year 2016, Question Number 4 (Please refer back to that year)

- Repeated from Year 2016, Question Number 12 (Please refer back to that year)

- Contribution Margin

- Repeated from Year 2017, Question Number 12 (Please refer back to that year)

- Repeated from Year 2019, Question Number 8 (Please refer back to that year)

- Repeated Question

- Solution:

Given,

Sales Unit = 20,000 units

Production Unit = 22,000 units

Opening Stock = 3,000 units

Closing Stock = ?

We know,

Production unit = Sales + Closing stock – Opening stock

or, 22,000 = 20,000 + x – 3,000

or, x = 22,000 – 20,000 + 3,000

or, x = 5,000

Hence, the production unit is 5,000 units. - Solution:

Given,

Fixed Cost (a) = Rs 150,000

Production Unit (x) = 15,000

Variable Cost Per Unit (b) = Rs 5

We know,

Total Cost (y)= a + b.x

= 150,000 + 5 * 15,000

= Rs 2,25,000

Hence, the total cost is Rs 2,25,000.

Group B

- The difference between variable costing and absorption costing are:

| Basis | Variable Costing | Absorption Costing |

|---|---|---|

| Treatment of fixed cost and variable cost | Variable manufacturing cost as well as fixed manufacturing cost as treated as product cost. | Only Variable manufacturing cost are treated as product cost and fixed cost is treated as period cost and charge to Profit / Loss account. |

| Valuation of Stock | Variable as well as fixed manufacturing cost are taken for stock valuation. | Only variable manufacturing cost are taken for stock valuation. |

| Measurement of profitability | Profitability is measured by profit, which is also a guiding factor for managerial decision. | Profitability is measured by contribution margin, which is also taking for decision. |

| Transfer of fixed cost | Fixed manufacturing cost taken for inventory valuation, thus transfer to next period with inventory. | Fixed cost are taken as period cost and not transfer to next period. |

| Uses | External reporting and useful for determination of tax. | Internal reporting and useful for planning controlling and decision making. |

- Definition -Repeated from Year 2016, Question Number 1 (Please refer back to that year)

Cost accounting is needed because of following importance or advantages:

- Help in cost control

- Help in Decision Making

- Help in fixing the Selling Price

- Help in Cost Reduction

- Help in Inventory control

- Helps in formulating the plans and policies

- Helps in checking the accuracy of financial accounting

- Reveals the profitable and unprofitable activities

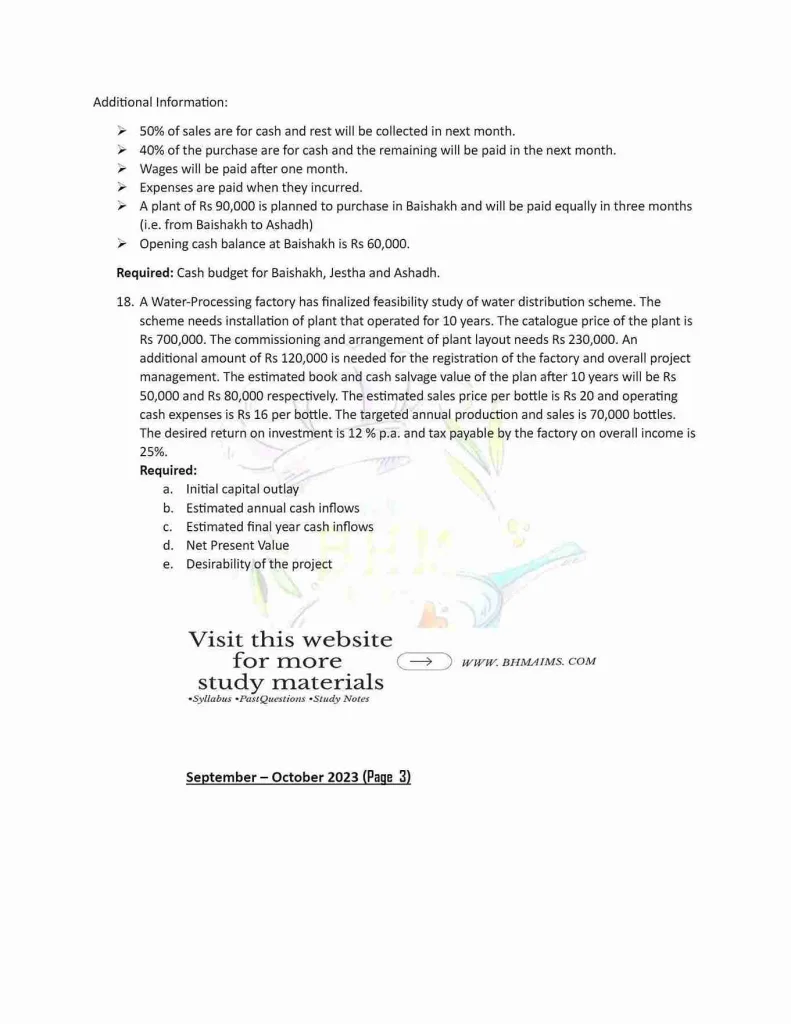

- Solution:

Calculation of Variable and Fixed Cost using Least Square Method

Taking 100 as common (Note: You can continue without taking also. We did it just to reduce to length of number; however the final answer will be same. Its like dividing 1000 by 100 or 100 by 10 both will get same result.)

Least Square Table

| Machine Hours (X) | Supervision cost (Y) | XY | X2 |

|---|---|---|---|

| 2 | 15 | 30 | 4 |

| 4 | 23 | 92 | 16 |

| 6 | 31 | 186 | 36 |

| 8 | 39 | 312 | 64 |

| 10 | 47 | 470 | 100 |

| ΣX= 30 | ΣY = 155 | ΣXY = 1090 | ΣX2 = 220 |

(a)

Variable Cost Per Unit (b) = (NΣXY – ΣX * ΣY ) / [NΣX2 – (ΣX)2]

= (5 * 1090 – 30 * 155 )/ [5 * 220 -(30)2 ]

= Rs 4 per units

Total Fixed Cost (a) = (ΣY – b* ΣX) / N

= (155 – 4 * 30) / 5

= Rs 7

Next,

(b)

Total cost for month of Ashwin when machine hours are expected to be 1,200:

We know,

Total cost (y) = a + bx

= 7+ 4 * 1,200

= Rs. 4807

Group C